Mama told me not to come.

She said, that ain't the way to have fun.

Yup, and I'm still critical of abortion, but because of similar stuff to what you said, my official position is essentially pro-abortion, with some caveats to discourage things I find truly awful (e.g. no abortion after learning the gender unless it's for a medical emergency).

Yup, my cat steals my socks all the time and pulls them deep under the bed. We don't let our cat out of the house, so it's only us (and mostly me) that suffers.

Honestly, I think it's more than half of our population that lacks critical thinking skills. Basically, there are two big camps, and both sides are screaming about how terrible the other candidate is without acknowledging how stupid it is that we only have two viable candidates to pick from for the most powerful office in the country, if not the world.

I personally think that Trump is way worse than Harris, but that misses the point entirely. I strongly dislike both Harris and Trump, yet voting for anyone else is "throwing my vote away." If we had a different voting system that took multiple preferences into account (ranked choice, STAR, approval, etc), we could maybe have viable third party candidates to pick from. But no, we only get two realistic candidates, and it seems the quiet majority is completely okay with that.

If we had a better system, people who strongly dislike Harris could vote for someone else first, with Trump as their backup, and people who strongly dislike Trump could vote for someone else first, with Harris as their backup. And maybe, just maybe, a halfway decent candidate could be selected instead of picking between two bad options.

I think more than half of the country agrees that Trump is terrible, they just don't agree that he's worse than Harris.

Yup, $1k for a decent headset, $1k for a decent GPU, and you also need space to play. It's a pretty big barrier to entry before you even get into the limited selection of games.

I would assume their bias is to make money, but it's hard to tell w/ those people.

You turn lesbian.

The only thing close to 20 point spread is betting odds, which are probably less reliable than polling, which says they're neck and neck. So we'll see.

Do the Finnish use different finish flags?

How would they get it there though? They'd have to get across China and Russian airspace, or go a long way around.

And people will be less likely to annoy you. It's a win-win.

I live in a quiet neighborhood and it's totally not an issue. Even when I lived in an apartment in a quiet neighborhood, it still was largely a non-issue. Quiet is good, and it encourages landlords and homeowners to install proper sound-proofing to preserve it.

It also turns out that a lot of the construction is due to cars in one way or another:

- new parking garage to store more cars

- fix roads destroyed by cars

- new buildings because others had to be removed to make space for cars

If you remove the cars and build with density in mind, a lot of that goes away.

Yup. I slow, inform, and then overtake when safe. If they don't seem to respond, I'll wait to overtake. On a bike path, I can usually just overtake with 3' (1m) space.

Yeah, as a cyclist, this pisses me off. I wear bone conduction headphones so I can listen to something while also hearing what's going on around me, and those idiots with loud music playing interfere with both.

I wear bone conduction headphones, so I get the best of both worlds, though background noise can get a little annoying.

Idk, they're a bit closer to Brussels, so there's that...

Agreed. It has gotten a lot better since I've been in the industry, but it still has a long way to go.

Sure, but it doesn't really pay the bills.

They are, just not disobedience against a government, but against what stores want you to do.

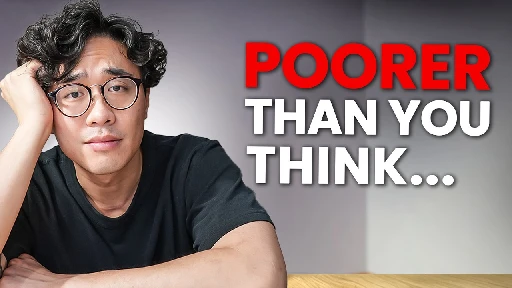

What Net Worth Puts You in the Upper, Middle & Lower Class?

YouTube Video

Click to view this content.

I found the graph at 10:55 to be especially interesting because it shows how someone with around the median income ($65k) can make it to the lower upper class by retirement through some discipline (10% saved per year).

As a quick TL;DW, here are the median incomes, net worth, and percent of population for each class:

- lower - $34k income, $3.4k net worth (many are negative) - 25%

- middle

- lower - $44k income, $71k net worth - 20%

- middle - $81k income, $159k net worth - 20%

- upper - $117k income, $307k net worth - 20%

- upper

- lower - $189k income, $747k net worth - 10%

- upper - $378k income, $2.5M net worth - 5%

Some questions to spark discussion:

- Do you agree with his breakdown of the economic classes? Why or why not?

- What strategies do you think someone in each category should take to improve their situation?

- If you don't mind sharing, what class do you think you're in, and does the breakdown match your experience?

What Net Worth Puts You in the Upper, Middle & Lower Class?

YouTube Video

Click to view this content.

I watched this video a couple weeks ago, and while it has nothing to do with FI, I thought it was quite interesting how he divides the economic classes. TL;DW:

- lower class ($34k income, $3400 net worth) - ~25% of population - truly struggle with emergencies and flirt w/ the federal poverty line; net worth is pretty much nothing (often negative!) due to student debt

- middle class - three categories (lower, middle, upper)

- lower ($44k income, $71k net worth) - ~20% population - identify more with middle-middle class and tend to get into more debt than necessary by trying to keep up with the Joneses, but could be financially stable w/ some discipline

- middle ($81k income, $159k net worth) - ~20% - financially stable, most of assets are in home

- upper ($117k income, $307k net worth) - ~20% - passive income and compound interest supplement income; some live paycheck-to-paycheck due to lifestyle inflation (i.e. keep up w/ next group), but some can do really well with investments

- upper class - two categories (lower and upper)

- lower ($189k income, $747k net worth) - ~10% - specialized professions; most people can get into the lower upper class with discipline (10% savings rate on $65k salary => $787k investments by age 50); little pressure from everyday expenses

- upper ($378k income, $2.5M net worth) - ~5% - some college grads working as employees, but a lot of these are business owners

At each level, I see two types of people:

- savers - have enough cash to weather emergencies, tend to have upward mobility

- everyone else - tend to stay in that economic class, and may regress in retirement; routinely keep up with the Joneses and stay in debt

I personally have been in the middle to upper middle class for most of my career (started in lower middle class, but that quickly changed), and I'm shooting for lower-upper class to upper-upper class in early retirement. I didn't get any inheritance and don't expect any, and I haven't been particularly lucky with my investments (for every major win, I can show an equal major mistake), I've just been very frugal. Some details:

- car(s) - single car for most of my married life; currently have two at 16 and 17 years old; I do most of my own maintenance

- house - bought in mid-late 20s and haven't moved

- savings rate - was 45%, but it's now 35-40%

- current income - upper-middle class range, might get to lower-upper class if I stick with my career; about half my career was middle-middle class

- FI target - something like $50-60k spending/year, or $1.5-2M; I plan to be FI around mid-40s, and I intend to keep earning income after FI, but the nature of my work will change

Anyway, I really enjoyed this video, and I think it's interesting to compare myself to the various breakdowns, as well as forward to people who argue that the main thing keeping them down is income (despite being middle-middle class or above).

What do you think? Do you agree with the breakdown? What do you think the "minimum" income range is for someone who'd like to pursue FI?

Retirement Calculators: the good, the bad, and what I use

I've been reading Yahoo Finance a bit recently due to all of the shifts in the market, and they have a PF section where they cycle through a variety of PF topics. One of them linked to a retirement calculator, which I had a lot of trouble with as someone looking to retire way earlier than typical, so I decided to go look at a few more and compare them.

Warning: these are pretty US-centric.

Smart Asset retirement calculator

- maxes out at 40% savings rate

- minimum retirement age is based on birth year (i.e. can't retire before today)

- default annual rate of return is 4%? This is worded oddly, because it's called "savings" and is right under "cash savings and investments"

- no option for HSA, but you can lump it in with IRA

- seems to estimate Social Security income, which is cool

- has on option to add a spouse, which was cool

This was was pretty awful, but with some fiddling, I got it to spit out some halfway decent numbers. It seems to be a simple flat return tool, so no backtesting or randomness at all, but it does try to account for taxes and whatnot. That said, it got my tax rate completely wrong for some reason.

I guess this is acceptable for someone to get a rough idea of what retirement looks like, but it was also really fiddly and buggy (i.e. Social Security age kept resetting to 66 for whatever reason).

My 401k provider (Empower)

- minimum retirement age is 50?!

- automatically pulled in elective deferrals and employer match, but it was way off (surprising because it's literally the custodian for my 401k...)

- can link accounts, but can't add any accounts w/o linking (weird, because my old 401k provider that they bought allowed me to)

- assumes 60/30/10 stock/bond/cash split, with no way to adjust it (I'm going 100% stocks)

- links with a budgeting app they have internally? Why would I use my 401k as a budgeting app??

- option to simulate what automatically increasing retirement contributions does (not useful for me, but could help others)

- option to add kids and estimate college expenses, which was cool

This one was absolutely terrible. Not only was it a pain to figure out how to input my numbers, it also didn't really give useful output. Even if I was a typical retiree, I'd still find it largely useless, unless my 401k was literally my only retirement account (which I admit is probably pretty common).

Fidelity brokerage

- retirement age must be greater than current age (can't retire immediately

- lots of estimates for retirement expenses (i.e. no stupid % of income metric)

- can set asset allocation for retirement accounts (domestic, international, bonds, etc)

- can link accounts, or just enter their values

- can add Social Security, and it'll estimate for you if you want

- seems to do some kind of back-testing because portfolio growth isn't a smooth line

All in all, I found Fidelity to be pretty good! It's easy to add all of the accounts and provide as much detail as I'd like, and I feel like the result is pretty realistic.

FiCalc

Primarily for backtesting withdrawal strategies, and it provides a bunch of tools, such as:

- withdrawal strategy - constant dollar, percent of assets, etc

- constant withdrawals (e.g. putting a kid through school, pay off house, etc)

- extra income - i.e. barista FI or whatever

- adjust range of historical data

It won't tell you when you can expect to retire, but it'll tell you your retirement plan's chance of success, which is way more important IMO.

Fire Calc

Primarily backtesting, but there are some knobs you can mess with as well if you click through the tabs:

- pensions/additional income

- future retirement date (plus how much you'll contribute until then)

- withdrawal strategies

- portfolio makeup

- additional portfolio additions (house sale, inheritance) and subtractions (one-time expenses at a certain point in retirement)

This is the first one I used, so it holds a special place in my heart.

What I personally use

I like mucking about with the above, but at the end of the day, I mostly just use my spreadsheet to estimate things. Some specific calculations I find a lot of value in:

- FI Date -

EDATE(TODAY(), NPER(...)) - progress toward FI -

1-(NPER(with current assets)/NPER(assuming starting from zero)) - Social Security calculator - this one exists, but it assumes zero inflation going forward; so I wrote my own in my spreadsheet that uses average inflation from my working career going forward, and actual inflation numbers going backward; not used in any calculators, but it's nice as a backup plan

- withdrawal simulator - how much I'd need to withdraw from tax-deferred accounts before RMDs, by SS max age, and SS min age (helps w/ tax planning)

But at the end of the day, the first is the only one that matters. I update my total spending about once/year, my investment accounts when I remember, and my savings rate comes from my budget. I periodically check my FI number against back-tested portfolios, but I've settled on a SWR of 3.5% and assume a 7% real market return.

Conclusion

These aren't the only retirement calculators I've played with, but the easier ones to access (i.e. search results or though 401k) tend to be pretty awful, while the good ones are a bit more hidden away.

I think with a bit of searching, you can find some decent tools without having to DIY. Then again, I prefer to DIY.

Do you have any retirement calculators you like? Do you DIY?

Looking for HW recommendations for DIY NAS/Homelab

Here's what I currently have:

- Ryzen 1700 w/ 16GB RAM

- GTX 750 ti

- 1x SATA SSD - 120GB, currently use <50GB

- 2x 8TB SATA HDD

- runs openSUSE Leap, considering switch to microOS

And main services I run (total disk usage for OS+services - data is :

- NextCloud - possibly switch to ownCloud infinite scale

- Jellyfin - transcoding is nice to have, but not required

- samba

- various small services (Unifi Controller, vaultwarden, etc)

And services I plan to run:

- CI/CD for Rust projects - infrequent builds

- HomeAssistant

- maybe speech to text? I'm looking to build an Alexa replacement

- Minecraft server - small scale, only like 2-3 players, very few mods

HW wishlist:

- 16GB RAM - 8GB may be a little low longer term

- 4x SATA - may add 2 more HDDs

- m.2 - replace my SATA SSD; ideally 2x for RAID, but I can do backups; performance isn't the concern here (1x sata + PCIe would work)

- dual NIC - not required, but would simplify router config for private network; could use USB to Eth dongle, this is just for security cameras and whatnot

- very small - mini-ITX at the largest; I want to shove this under my bed

- very quiet

- very low power - my Ryzen 1700 is overkill, this is mostly for the "quiet" req, but also paying less is nice

I've heard good things about N100 devices, but I haven't seen anything w/ 4x SATA or an accessible PCIe for a SATA adapter.

The closest I've seen is a ZimaBlade, but I'm worried about:

- performance, especially as a CI server

- power supply - why couldn't they just do regular USB-C?

- access to extra USB ports - its hidden in the case

I don't need x86 for anything, ARM would be fine, but I'm having trouble finding anything with >8GB RAM and SATA/PCIe options are a bit... limited.

Anyway, thoughts?

The Fed’s preferred inflation gauge had its slowest annual increase in more than three years, likely getting policy makers closer to the conviction needed to ease monetary policy.

Looks like inflation is around 2.6% and holding steady/falling slowly.

This is good news for the stock market and could impact elections in November since we'll likely see a rally if rates do get cut in Sept.

The L.P. presidential candidate clarifies his views, amid criticisms that he is too "woke."SubscribeYouTube: http://youtube.com/reasontvApple: https://podcas...

This interview mostly goes over social policy, so I hope there's a follow-up with fiscal policy as well.

Here's an AI-generated transcript, which has some mistakes but hopefully is helpful. I tried copying it here, but it was too long.

Some interesting tidbits I liked:

- Liz challenged Chase on gender affirming care - his response was "no to surgery before 18, yes to medication if parents and doctors agree"

- open borders - wants an "Ellis Island"-style system where you register and then get to work, while still maintaining a strong police presence to keep out criminals

- courting those on the right of the LP - wants to work together on common causes, but will disagree on social issues

- vaccine mandates - no mandates from the government, but private businesses absolutely can; he thinks businesses requiring masks/vaccines is stupid because it limits customers

The whole discussion was pretty interesting, and I think it's interesting that Liz Wolfe came out as more conservative than Zach (apparently, Zach rarely discusses personal opinions).

So far I'm pretty happy with Chase as the candidate because:

- he's pretty well-spoken - reminds me a bit of Gary Johnson with less "aloof"-ness

- he appears confident and seems to do a good job justifying his positions on core libertarian principles

- very different from both Trump and Biden, so he should contrast well

- going after young voters - he's young, and he's highlighting issues that young people seem to care about, so I'm hopeful that'll resonate with young voters

I certainly disagree with him on some issues, but I think he'll be a good voice for the party. I would like to see more discussion on economic policy though.

Anyway, what are your thoughts? Are you excited for a Chase Oliver campaign, or do you think the Libertarian Party should have made a different choice?

IRS opening free online tax filing program to all states

This is exciting for me because:

- I model ny taxes in my spreadsheet anyway, so I'm likely to notice a mistake

- I usually use FreeTaxUSA to file for free, and this means there's one less party to share my personal information with

- my state's taxes are pretty simple, so I don't need state-specific tax software

I hope this helps simplify things for some people and save a bit of money as well. I'm going to try it out next year.

Do any of you estimate your taxes? Are you interested in trying out this service?

Contributors developing the Aeon Desktop are happy to announce a major milestone with the launch of Release Candidate 2 (RC2) images. Within the last 24 hour...

Looks like most of the improvements have nothing to do with GNOME, so they should also probably impact Kalpa (the KDE MicroOS distro).

I'm particularly interested in these developments because I'm going to upgrade the CPU on my NAS (old Phenom II -> Ryzen 1700), and I'm considering reinstalling w/ MicroOS. It's currently running on an old SATA SSD, but NVMe drives are getting so cheap that it's probably worth an upgrade.

Chase Oliver of Georgia won the Libertarian Party's presidential nomination in dramatic fashion on Sunday night.

> Oliver's victory on Sunday night was a blow to the Mises Caucus, the right-leaning faction that took control of the Libertarian Party at the 2022 convention and that had orchestrated Trump's appearance at the convention. That faction's preferred candidate was Rectenwald.

I'm not a fan of the Mises Caucus, so I think this is hilarious.

> There was widespread media attention in recent weeks fixated on whether the Libertarian Party would nominate a prominent non-Libertarian like Kennedy or even Trump. > > Neither got anywhere close to winning. Kennedy was eliminated after the first round of balloting, while Trump did not even qualify for the first round and received just six write-in votes.

Good on you LP.

Now, I know next to nothing about Chase Oliver, but being gay and young will certainly set him apart from the old men he's competing against. I hope he'll get a good amount of media attention to spread the libertarian message.

Anyway, what are your thoughts? Did the convention make the right call? Would one of the other candidates have been better? Would you prefer no candidate?

Bill Perkins, author of Die with Zero, joins Chris Hutchins on the All the Hacks podcast to discuss memory dividends and how to spend money!

I haven't finished listening to this, and unfortunately there isn't a transcript. According to the comments, the transcript exists on Spotify (I don't have a subscription, sorry), so that can be an option.

Anyway, I'm well on my way to my number, so I've been thinking about maximizing my time while I wait for the market to do its thing.

I've been listening to a lot of The Money Guy show recently, which has a lot of overlap with the FI mentality, and the recording theme is to optimize for enjoyment. I think that's something I've been forgetting recently, so I'm glad I found this podcast to help keep me grounded.

Anyway, thoughts? How are you spending you time now? How to you expect that to change when you're FI? Are there changes you'd like to make to optimize things today?

While focused on the openSUSE Innovator initiative as an openSUSE member and Intel Innovator, it was frustrating for me to see that openVINO did not have sup...

> OpenVINO is an open-source toolkit for optimizing and deploying deep learning models from cloud to edge. It accelerates deep learning inference across various use cases, such as generative AI, video, audio, and language with models from popular frameworks like PyTorch, TensorFlow, ONNX, and more. Convert and optimize models, and deploy across a mix of Intel® hardware and environments, on-premises and on-device, in the browser or in the cloud.

Average Retirement Savings Balance by Age

Here are just the number for all of you degenerates who just want some milestones for your spreadsheets.

Average total retirement savings by age:

- <35 - $49,130

- 35-44 - $141,520

- 45-54 - $313,220

- 55-64 - $537,560

- 65-74 - $609,230

- >=75 - $462,410

Average 401k balance by age:

- <25 - $5,236

- 25-34 - $30,017

- 35-44 - $76,354

- 45-54 - $142,069

- 55-64 - $207,874

- 65 and older - $232,710

And retirement savings targets from various advisors:

Fidelity:

- 1x by 30

- 3x by 40

- 6x by 50

- 8x by 60

- 10x by 67

Rowley:

- 1x by 35

- 5x by 50

- 7x by 70

Anyway, do you like metrics like these?

openSUSE.Asia Summit will come back to Tokyo, Japan The openSUSE Project is exciting to announce that openSUSE.Asia Summit 2024 is going to be held in Tokyo,...

Important dates:

- expected summit date is Nov. 2 and 3 soon after Open Source Summit Japan

- call for speakers is going to end around the end of July

There will be another announcement in a couple weeks.

The openSUSE will undergo a critical update with the migration of Weblate to a hosted solution. Shifting to a hosted solution for the web-based localization ...

May 10, 2024 (text in body)

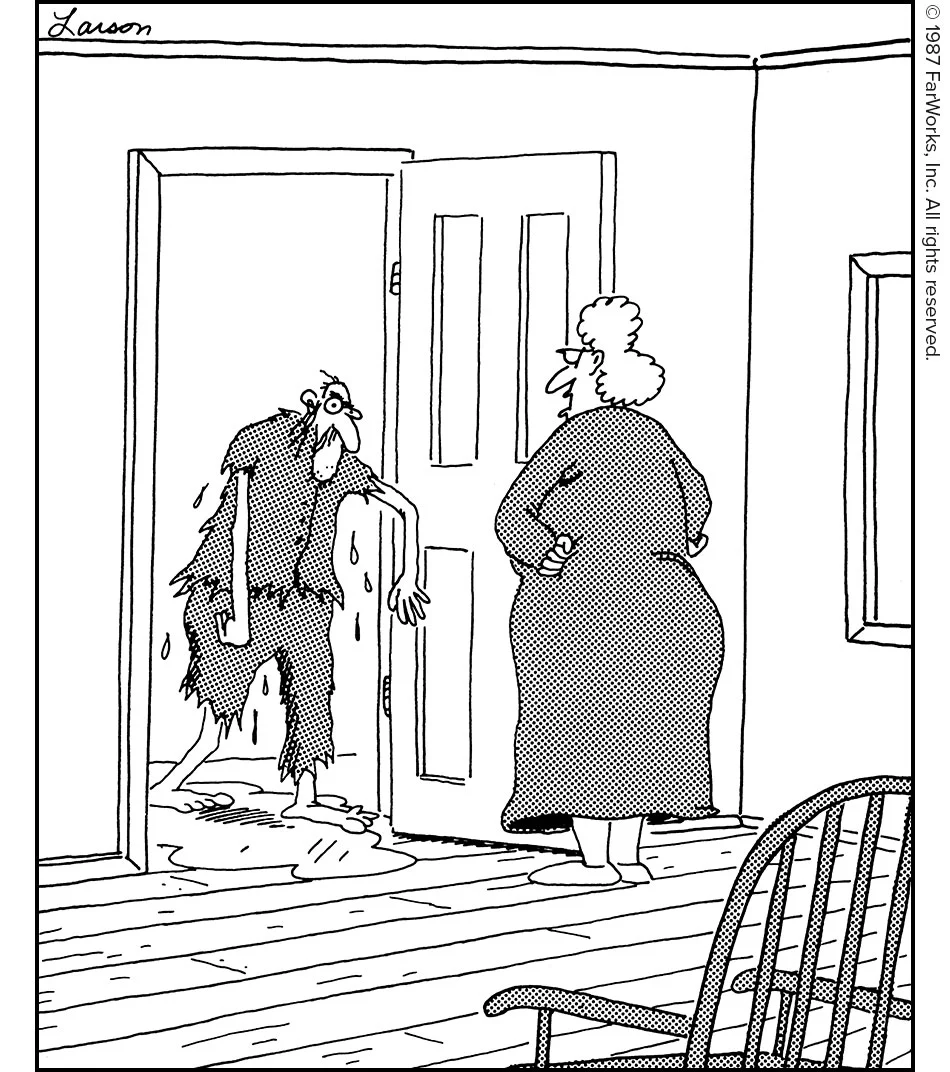

> For crying out loud, Jonah! Three days late, covered with slime, and smelling like fish! … And what story have I got to swallow this time?

May 10 2024 (text in body)

> You know what I’m sayin’? … Me, for example. I couldn’t work in some stuffy little office. … The outdoors just calls to me.

May 10 2024 (text in body)

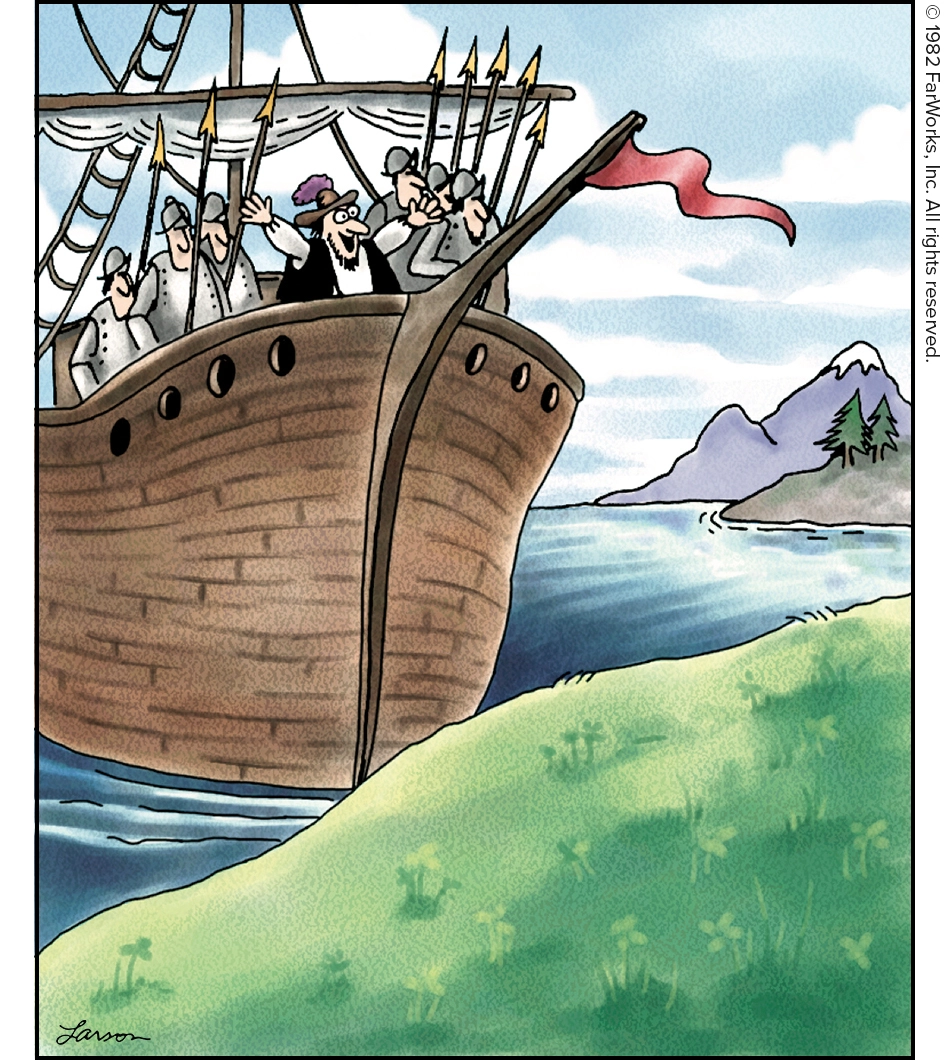

> Look! Look, gentlemen! Purple mountains! Spacious skies! Fruited plains! … Is someone writing this down?

May 10 2024 (text in body)

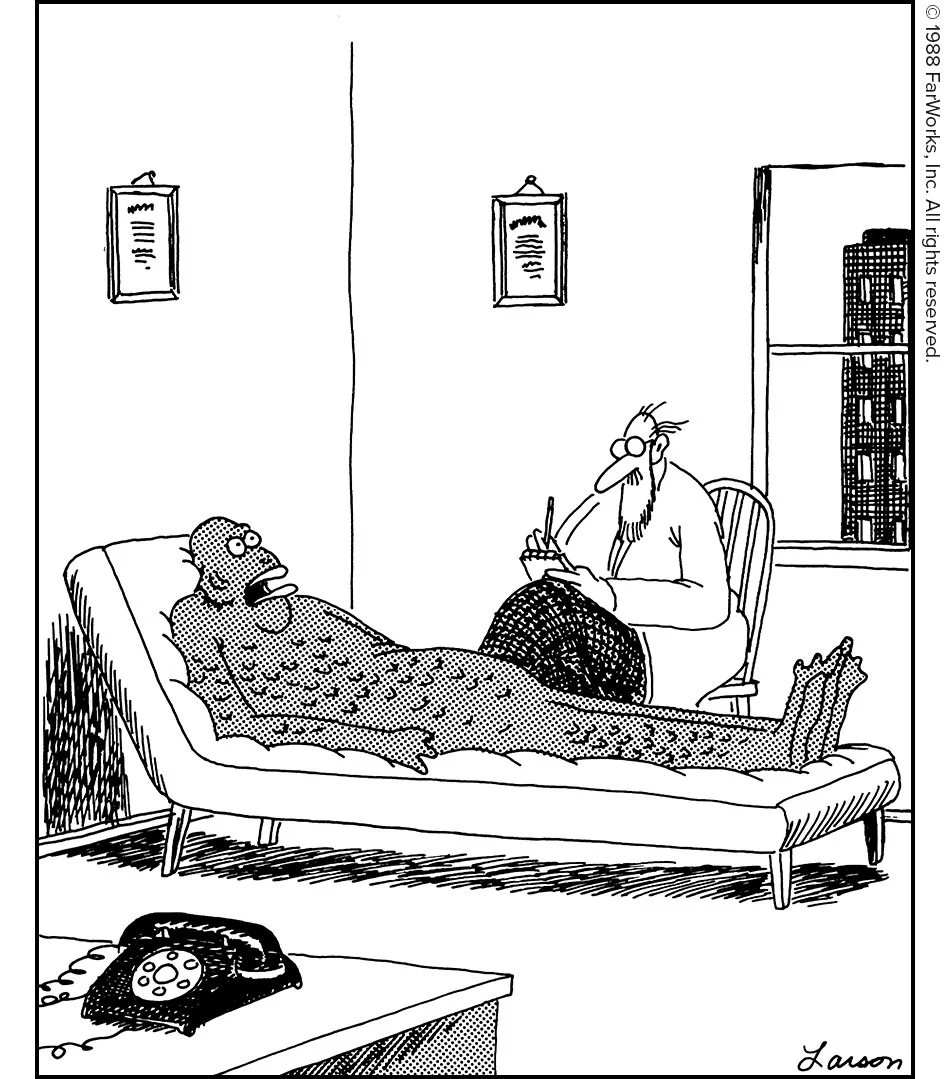

> Sure, I’m a creature—and I can accept that … but lately it seems I’ve been turning into a miserable creature.