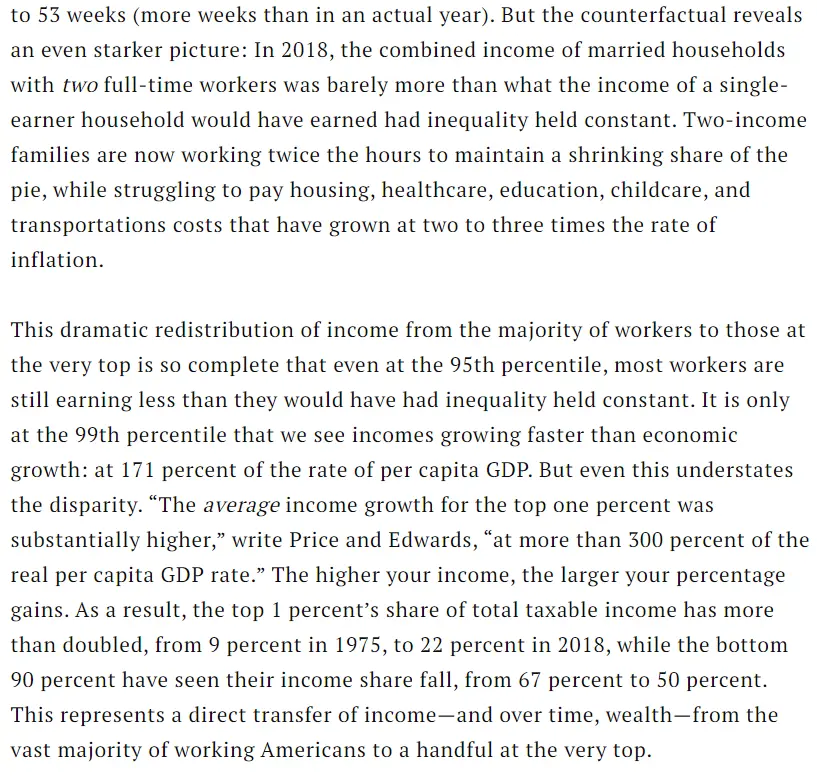

Work More for less pay while you get fleeced by the 1% - 50 Trillion stolen from us

Source: https://time.com/5888024/50-trillion-income-inequality-america/

"On average, extreme inequality is costing the median income full-time worker about $42,000 a year. Adjusted for inflation using the CPI, the numbers are even worse: half of all full-time workers (those at or below the median income of $50,000 a year) now earn less than half what they would have had incomes across the distribution continued to keep pace with economic growth. And that’s per worker, not per household."

We are getting stolen from everyday by the billionaire class who have bought themselves politicians and the media to keep you from getting what you deserve

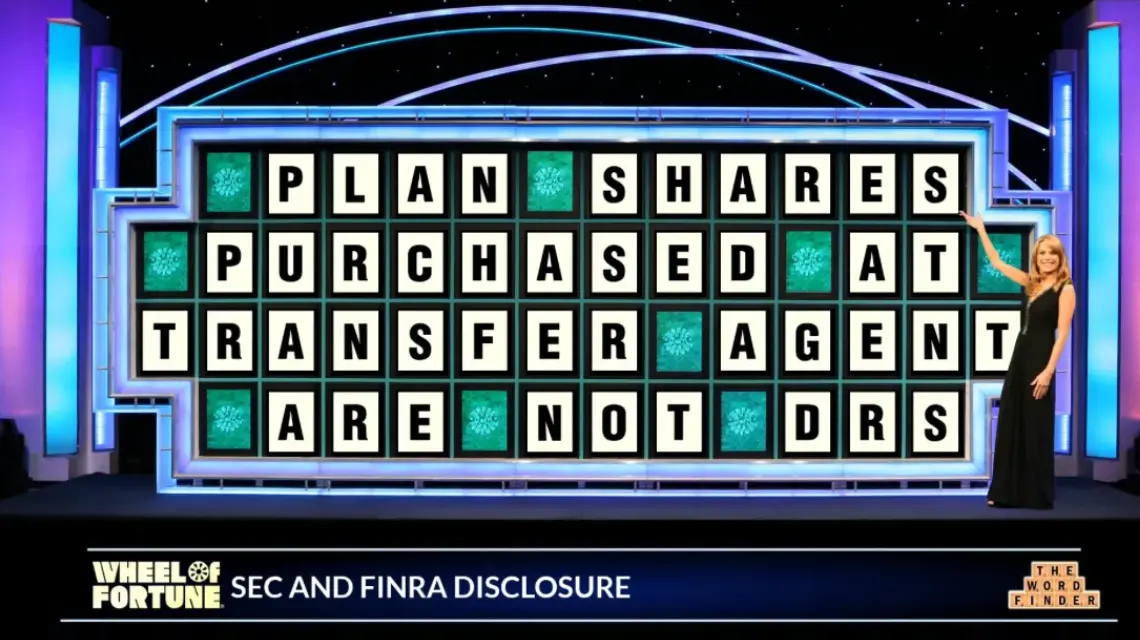

"Can always appeal" .... and we will always say no

One way to help is spread the message to users on other platforms. Talk about DRS as much as you can and there is even stickers and business cards that are created by the whydrs team to help spread the DRS message IRL

Great Graphic btw really shows where a lot of people get their information. Would be interesting to contrast it with corporate propaganda channels such as CNN, FOX, MSNBC etc

Do you have any links to who owns these organizations? We could also look into common links such as Board of Directors, which hedge funds are invested in them etc...

Great Graphic btw really shows where a lot of people get their information. Would be interesting to contrast it with corporate propaganda channels such as CNN, FOX, MSNBC etc

It would also be interesting to see how many of those accounts are bots used to spread certain messages and control sentiment

Great write up Chives. The more we learn about DRS and actually owning your shares so no broker can get their hands on them the better!

This is a good place to have the DD in a forum as twitter is not that great for it. A way to bring content over from twitter is to cross post over here. Nice thing is the DRSyourGME team also has a server here so we are truly becoming decentralized. Here is the DRSyourGME community Lemmy: https://lemmy.whynotdrs.org/

Thank you Ross! For those that don't know DRSyourGME was also banned from reddit and have taken refuge here:https://lemmy.whynotdrs.org/

It is a community that are invested in BBBY. We have followed the bankruptcy process and dockets to better understand our investments. There is a belief that Ryan Cohen who is listed as a creditor and interested party will buy BBBY and merge it into a new company to challenge Amazon. There was a subreddit called thePPshow but was banned by reddit. They also have a Youtube livestream where they discuss and just today had Bill Pulte join.

Same but also felt there have been so many stories that I have been missing. Another issue with US based media is it only focuses on the US vs the world which creates just as much issues. We are very interconnected with everyone and the criminals at the top do not care about borders. Many of these organizations I linked do a great job looking at global problems from journalist directly on the ground and are local

Tired of Corporate Propaganda? Do you wish we had more independent and investigative journalist? Here are some alternatives that's exposing the corruption in our world

“And if all others accepted the lie which the Party imposed—if all records told the same tale—then the lie passed into history and became truth. ‘Who controls the past’ ran the Party slogan, ‘controls the future: who controls the present controls the past.'” ~George Orwell, “1984”

Every day we are subject to corporate propaganda and we do not even notice it. Our beliefs and core values get influenced and neighbors are pitted against each other. The news we see is increasingly spreading fear creating a darker and darker world around us. We need alternatives. We need independent journalism that is more widespread.

Some Stanford professors coined the term the Dune affect: "The Dune affect, which states that those who control the media control the opinions of the people"

"Modern propaganda uses all the media available to spread its message, including: press, radio, television, film, computers, fax machines, posters, meetings, door-to-door canvassing, handbills, buttons, billboards, speeches, flags, street names, monuments, coins, stamps, books, plays, comic strips, poetry, music, sporting events, cultural events, company reports, libraries, and awards and prizes. It is most likely that some of these media uses are surprising, but that only serves to show how easy it is to not even recognize propaganda as such. For the purpose of our paper we will focus on mainly the usage of the press in their tactics of shaping people's opinions. The press (newspapers and magazines) is important because the most current news and issues are spread every day through them.

Indeed, propaganda is so powerful because everyone is susceptible to it. This is true as explained by Robert Cialdini, an expert in influence, because people exist in a rapidly moving and complex world. In order to deal with it, we need shortcuts. We cannot be expected to recognize and analyze all the aspects in each person, event, and situation we encounter in even one day. We do not have the time, energy, or capacity to process the information; and instead we must very often use our stereotypes, our rules of thumb, to classify things according to a few key features and then to respond without thinking when one or another of these trigger feature are present (Cialdini 6). While this makes people highly susceptible to a propagandist who understands persuasion, in general it is the most efficient for of behaving, and in other cases it is simply necessary. Additionally, propaganda includes the reinforcement of societal myths and stereotypes that are so deeply embedded within a culture that it is often difficult to recognize the message as propaganda."

Our media has become increasingly centralized and has been taken over by the billionaire oligarchy. Corporate Propaganda media is controlled by 15 billionaires ahem oligarchs

Here are some organizations that look into corruption and do investigative journalism:

International Consortium of Investigative Journalist (the people who broke the Panama Papers, Pandora Papers and just last week Cyprus Papers)

The Signal Network (Whistle blowers)

Anti Corruption Data Collective

Global Investigative Journalism Network

International Journalist Network

Future Crunch (positive news)

International Federation of Journalist

I will leave with this video which encompasses how wide spread this problem is: This is extremely Dangerous to Democracy

The transfer agent for BBBYQ is AST not computershare which sadly they are not as good as CS. I DRSd a large portion +95% of mine just to be safe. After seeing how much DRS is suppressed and how it gives me clear ownership of my shares especially when the stock is heavily naked short. It is up to you to decide what is the best way and what you are comfortable with.

They do that to me too and others in the BBBYQ community. Take this guy for example: https://twitter.com/pirateportfo/status/1630181132494049280

I have liked that post probably 20 times now and each time it is removed and I see it is capped at 790 or 791.

This may be relevant: https://www.reddit.com/r/Superstonk/comments/vwldv8/crazy_wild_speculation_on_bbbygme_connection/

TLDR: Theory is AST who is owned by Equiniti getting bought by Gamestop and then BBBYQ shares and subsequently Teddy shares go on blockchain and the NFT marketplace

I have been doing some research on this and contacting organizations. You can find my posts here:

https://lemmy.whynotdrs.org/post/24204

https://lemmy.whynotdrs.org/post/173450

https://lemmy.whynotdrs.org/post/225079

An AIG will be perfect in using our voice within the market. It will give us more credibility with the SEC and the Company. We will be able to push for changes on DRS and if need be getting a board seat to speak to what we would like. There are so many changes that can be made with shareholder resolutions:https://www.whydrs.org/shareholder-proposals-guide

Sadly there is not that much information out there in how to create one. We will be the first of hopefully many. With this organization we can push for DRS in not only gamestop but also the whole market. ShareAction whom I have contact with targets Asset managers and Pension funds to support their proposals on ESG. This puts pressure on the company and encourages change and will gradually put pressure on other companies to do the same. Wall Street really does not like Activist investors as they mess with their game they have rigged. Imagine if household investors who are getting introduced more and more to the market learn about the power of shares and the benefits of being invested in a company.

Welcome! Sadly reddit has been suppressing DRS talk for awhile now but luckily we found a place to discuss and push for more advocacy

AIG conversation with ShareAction

Last month I discussed with a member from ShareAction on ways to build an AIG. It is looking like creating a not for profit organization will be the best way to do so. With a not for profit we will have flexibility to bring together voting power of shareholders and create research on DRS.

I am still reaching out to organizations on how to go through the process of creating an AIG alas there are not many AIGs out there. If you would love to help one way to do so is look for organizations that use shareholder resolutions to influence companies. The more we understand this process the more impact we can have.

Now onto the conversation I had with ShareAction. During this conversation I inquired about how they began and what their strategies are. Their main focus is on ESG and to do so they interact with asset managers and asset owners. When the group was originally formed they mainly contacted pension funds to push for certain shareholder resolutions. He described the organization like an umbrella with 3 main objectives:

- Policy and engaging with Policy Makers

- Individual corporate campaign: activities and activism focused on certain theme in climate

- Financial sector standards talking to asset managers and asset owners and allows to hold them in account for who supports them and those that do not

With asset managers he brings up a good point on how we can start advocating for the company and get into contact with asset managers. For their movement they are in contact with 600-700 asset managers and this number is growing as their footprint has been getting larger. The hardest part they have faced is getting their foot in the door with asset managers. When contacting these asset managers they needed an advantage so they could be listened to and for them it was through smaller issues that larger organizations are not covering. The member I am in contact with is the senior manager for financial engagement and has never heard of the Direct Registration system. He was not aware of voting issues and how votes can be discarded. This can give us an advantage with these asset managers as we know a system of the market that they have never heard of. We have immense knowledge on the DRS system which can be supported by evidence on Failure to Delivers, and votes being thrown out as there are too many shares.

Utilizing asset managers, asset owners, and pension funds they are able to put pressure on the companies and their shareholder resolutions are more likely to succeed. One way they are able to get pension funds more involved is if the shareholders in the funds put pressure on their pensions such as threatening to move shares out.

Regarding the organization they are a not for profit which is what he recommends we create the AIG as. As a not for profit they are a charity organization and survive through volunteers and donations. This allows them to be agile and cover a wide range of topics as long as they have a theme. We will need to learn more about what this entails and how we can go about setting this up and what state we will want to do it in.

Along with pushing for policy and engaging with asset managers they also conduct research which is a critical part to what they do. This is similar to us where it is very important to keep on writing DD and exposing the corruption within the market. This will allow us to push for DRS and help us narrow down our shareholder resolutions as it is imperative that we create a detailed resolution. He emphasized that when creating resolutions the most detailed are the ones that are more likely to succeed. One of the first things we should do is send a private letter to Gamestop detailing what we would like them to do, much like how Ryan Cohen sent a letter to the board before he started to take control. If there is pushback then we can start going public and pushing for resolutions at the AGM.

If you have any questions you would like asked send them my way and I can email him or set up another meeting.

The stock has moved to expert market which retail cannot buy on after the SEC changed rules back in 2021. Many people are DRSing to prevent their broker from force liquidation however I am not sure how it works on Trading 212.

We are currently waiting on an updated plan to see if we are going to be liquidated which as of the recent 8k we may have an effective date of September 30.

Those are some good edits! I agree it will be important to discuss our interview with Gary as it helps give us some more authority. Making the statement broad is a good idea as it can help demonstrate the actions unions can take as shareholders and all the benefits. We can edit this letter and then create a list of unions and contact information so we can begin networking. We should also make a letter for asset managers and pension funds for DRS as they will be key in spreading information

Letter to Unions on an AIG

As we are building out the whydrs database and beginning to form an AIG, I created this letter to help begin advocating. Unions are the perfect organizations to help spread the messaging around an AIG as they already have the structure put into place and some companies even give workers shares. If you would like to learn more about an AIG you can see from my post here

---------------------------------------------------------------------------------- Dear [Insert Union],

I would like to express my support for your union and encourage you to continue the fight against [Insert Company]. I am in full support of achieving large increases in raises and other benefits. One benefit many public companies provide is shares within the company. I would like to raise awareness of the powerful benefits of this and how as a Union you can help revolutionize how workers take charge of companies.

I am part of a movement that is taking on Wall Street and the ownership of companies. We are beginning to form an Activist Investment Group (AIG) and spread messaging around Directly Registering Shares and the importance of shareholder resolutions. An AIG is a group of investors or in your case workers that utilize their share power to restructure corporations in a variety of ways. One such way is by using their shares to change the board of directors. This allows the group a direct voice in decision making in the company and how policies should be made. Most of these activist investor groups have been facing off against climate change in order to change company policy regarding its impact on the environment. I have compiled a small list of Activist investor groups so you can read what they do and the impact they have.

We have compiled a helpful guide on shareholder resolutions at whydrs.org. We have communicated with the SEC chairman Gary Gensler on Direct Registration and sent him this packet.

As a union you have the power of your labor to leverage in deals with the company. What if you were able to use the power of shareholders to continually change policies within companies every year at Annual Shareholder Meetings. At these meetings board members are voted on, policies for the company, and share buy backs. In 2022 $900 Billion worth of shares were bought back. If workers were able to hold shares within the company they will also receive this benefit as many CEOs and board members do.

I am not a financial advisor and none of this is financial advice. I am merely a humble worker who wants to see this world change for the better and one way to do so is fighting back against large corporations. Good luck on all your actions as a union and I wish you all the best.

Here are some helpful links: The Director’s Guide to Shareholder Activism (Harvard)

Proxy Access Reform: The SEC Makes It Potentially Easier for Shareholders to Nominate Directors

SpartanNash, activist investor group sparring over company’s direction

Thank you!

----------------------------------------------------------------------------------

Feel free to use this as a template and edit what you want. To continue down this route of communicating with Unions we will need a list with their companies and contact info. They are a great place especially now as many are striking for better contracts.

The way I understand is that FTD are a symptom of infinite liquidity for what they are unable to close out. When there is huge action and more buys are going on this is when they lose control and we see more FTD.

In the congressional hearing they even mention that infinite liquidity is just part of the system as they try to allow everyone to buy.

They have had years to learn how to hide their crime. It’s a mix of PFOF, FTD, swaps and probably much more that we have yet to uncover that allows them to hide it all from both us and the SEC. The issue is they have the tools and with both a hedge fund and a market maker branch are able to internalize everything in their system preventing outside eyes. Are there other metrics that we are missing? Is the Consolidated audit Trail (CAT) not enough and have loop holes we have not noticed. What about the netting system?

The only way we are able to find out and take away liquidity is to DRS. Eliminate the middleman and take back ownership

Taking on Wall Street with an AIG

As we have been on this journey for the last 2 and half years we have accumulated knowledge regarding market structure, hedge fund influence, loopholes utilized to manipulate price, and how to own shares in our own name. We have been beaten down by corrupt mods and have had to migrate a few times during this journey. We are harassed and mocked by corporate propaganda channels. We have been confined and our voice limited but our will to change how our market works will not be diminished. We need to find new ways to fight against Wall Street and expand our voice. One of the ways to give more credibility and resilience to the movement is to create an Activist Investor Group.

An AIG is a group of investors or in many cases hedge funds that utilize their share power to restructure corporations in a variety of ways. One such way is by using their shares to change the board of directors. This allows the group a direct voice in decision making in the company and how policies should be made. Most of these activist investor groups have been facing off against climate change in order to change company policy regarding its impact on the environment. I have compiled a small list of Activist investor groups so you can read what they do and the impact they have.

SOC investment Group ShareAction

“Follow This submitted another resolution, this time asking Shell to align its emission targets with the Paris climate agreement. Shell directors call this proposal a ‘fundamental misunderstanding’ and ‘unreasonable’, but 6% of shareholders voted in favour of it, double that of 2016.”

“Our money should power social progress. We hold shares in some of the biggest companies and every year, we organise questions at annual general meetings (AGMs) to challenge them on the issues that matter. We also gather together individual and institutional investors to co-file resolutions on specific topics at companies to demand change.”

There are many instances where Activist Investor Groups write a letter to the board and cause changes in the board makeup.

At Kohl’s an AIG with 10% of the shares cut down board nominees.

SpartanNash had to fight off an AIG with 5% of shares that sought to replace board members.

Exxon, Chevron, Shell all have faced off growing AIGs that seek to reform the company from the inside. With their collective power they continue to combat greedy wall street execs in order to gain their own power within the company. When searching about AIG there are many articles that present them in a negative light. Including this article about Exxon where the climate group was able to gain a couple board seats.

Activist investing is seen in a poor light by many as you are challenging the status quo. MSM put out articles bashing groups that look to utilize their share power to change a company. Many consulting groups put out guides on how to protect against activist investors. As we have experienced, directors are a way for hedge funds to control a company bringing it down from the inside. What if a group of investors that band together in common interest does the same thing? With a collective might we will be able to have a direct say in a company and influence decision making including decisions such as an NFT dividend.

Here is an article by Harvard Law that talks about shareholder Activism. CFI also discusses what shareholder activism is and even mentions Carl Icahn. The SEC released a paper called: “Proxy Access Reform: The SEC Makes It Potentially Easier for Shareholders to Nominate Directors” regarding shareholders and their role in appointing directors. There does not seem to be much material regarding shareholder groups as most of activist investors are either a hedge fund or a person such as Carl Ichan and Ryan Cohen. If we decide this is a path to take we will be trailblazing a new frontier for shareholders.

With an AIG we as shareholders will be able to engage directly with Gamestop and the Board. We will be able to put forward proposals and resolutions communicating our concern. With an AIG it will be a front that can be used to directly engage with the SEC or any other institution on a legal front.

This then leads us to the questions of how do you create such a group? One way is to create a non-profit, then will have to register the group, create branding and a name. Lawyers will have to be involved especially when setting up the bylaws and organization. Where will funding come from and how do we determine the leaders of the group?

We are creating something that has never been done before so we should be innovative in our structure and governance. We have repeatedly seen bad plans and bad actors take advantage of us and hinder any progress. Is there a decentralized structure that can be created? What safeguards can be created to prevent institutions from joining in?

More research is needed and I encourage you all to dig into what is possible with an AIG and how we can best utilize it.

I have been looking into this more and have identified a few groups: Climate Action 100, SOC investment Group, ShareAction, Follow This. I have reached out regarding some of these with questions and am waiting a response back. From what I can see we are creating something that has never been done before especially with us having our shares in DRS. From what I can see you become a member by holding a share in the company and contacting the AIG. You then become a member of the AIG in support of a common voice. There are some AIG that are located in London and Amsterdam so it may be possible for it to be international.

Welcome to Lemmy! Great to have you here and can't wait to see your post joining the fediverse

Surprised I didn't get a ban for explaining what it is