"Amazon insisted I report my missing package to the police". Although it was marked as ‘delivered’, it won’t believe it wasn’t.

Amazon, however, told me that without the report and crime number it couldn’t help. At a time when the police are under significant pressure, Amazon’s insistence on reporting missing packages is, at best, in bad taste and, at worst, contrary to consumer rights and protections.

In 2016, CEO and co-founder Matthew Prince told the BBC about the beginnings of Cloudflare.

Cloudflare's roots go back to 2004 when Mr Prince and Cloudflare co-founder Lee Holloway were working on a computer industry project they called Honey Pot.

The idea was that people with websites signed up for free, to install software which then tracked people who sent unsolicited emails.

Five years later Mr Prince was doing a Master of Business Administration (MBA) at Harvard Business School, and the project was far from his mind, when he got an unexpected phone call from the US Department of Homeland Security asking him about the information he had gathered on attacks.

Mr Prince recalls: "They said 'do you have any idea how valuable the data you have is? Is there any way you would sell us that data?'.

"I added up the cost of running it, multiplied it by ten, and said 'how about $20,000 (£15,000)?'.

"It felt like a lot of money. That cheque showed up so fast."

Mr Prince, who has a degree in computer science, adds: "I was telling the story to Michelle Zatlyn, one of my classmates, and she said, 'if they'll pay for it, other people will pay for it'."

And so the idea for Cloudflare was born, with Ms Zatlyn as its third co-founder.

That is a very sad story indeed. Mother told children to leave her so they could survive

The mother of the four young Colombian siblings who managed to survive for almost six weeks in the Amazon jungle clung to life for four days after their plane crashed before telling her children to leave her in the hope of improving their chances of being rescued.

Yeah, I just posted this in another thread.

They set an impossible standard for a technology

Maybe that's the case but it's not what the article says. Experts say that "the surge in Tesla crashes is troubling" and that "the number of fatalities compared to overall crashes was also a concern". And they are critical of Tesla as the company is obviously beta-testing a car on the highway without disclosing its data as others have already said.

I don't see someone setting impossible security standards, at least that's how I read the article. Tesla appears to value its profits more than the safety and lives of people.

A single chart about the wildfires in Canada - so far.

June 15-17, 2023: "Money as a Democratic Medium 2.0"

Money as a Democratic Medium 2.0 June 15-17, 2023 Cambridge and Hamburg Schedules Updated! Cambridge, MA June 15-17, 2023 HARVARD LAW SCHOOL Sponsored by: INET; PERI, University of Massachusetts, A…

To whom it may concern.

Even the Roman money -although it was issued by a central authority- was backed by gold, silver, bronze and other commodities, at least partially (inflationary debasement of coins became an important feature over the centuries).

But, yes, to a high degree this is hairsplitting, and you may agree that comparing currency systems of different historical epochs doesn't make sense as their economies and societies are too different for such a rough comparison.

What I say is that our current fiat currency system -the one we have since 1971- is unique in that it is largely created by banks themselves: The money volume created by the fractional reserve system is much larger than the volume printed by the central bank (~ ten times). This is unique in history to the best of my knowledge, l don't know of a similar example. And imo it is a huge part of the current financial problems we have been facing for some time, including the problems described in the linked article.

Fiat means decree, and fiat money is a currency that is decreed and backed by the government that issues it, meaning it is not backed by a commodity, such as gold or silver. This kind of currency has a short history as it arrived only in the 20th century (the only exemption were a few years in the 1860s in the US during the civil war, but that aside, fiat money was unknown in human history before 1913/14).

It has its name by the absence of this backing, but it has nothing to do with a threat to end one's life or a cage or something.

everyone will be better off when the banking systems collapse

I think no one would be better off if the banking systems collapse. We needed some reforms, including the fractional reserve system (I'd celebrate the comeback of the gold standard, for example), but no disaster, please.

giving power of currency to a very few people is bad for everyone.

Absolutely, I really couldn't agree more. In my humble opinion, however, it's not the power of currency to a very few people but rather the power of the only currency to a very few people which is bad.

This is why I'd say -once again- we need complementary currencies. Each of them will have its own drawbacks, but with a universe comprising fiat money and many alternatives at the local, national and maybe even global level for different use cases we'd be all better off imho.

US banks may be forced to sell commercial mortgages and reduce commercial lending in coming years due to high concentration risk, analysis claims

News of the FDIC’s takeover of First Republic and the immediate sale to JPMorgan keeps the question of liquidity at the forefront of discussion in the commercial mortgage-backed securities (CMBS) and commercial real estate (CRE) markets.

"With a contraction in bank liquidity and lending and an increased radar for bank stress testing from regulators due to the recent turmoil, banks with the highest [Commercial Real Estate] concentrations could see a pull-back on their lending books to allow their debt to roll off," writes Trepp, an analyst specialising in securitized mortgages. As a result, there could be lower origination volumes in the coming months and years.

Nature has learnt that the periodic table, as well as evolution, won’t be taught to under-16s as they start the new school year.

The news that evolution would be cut from the curriculum for students aged 15–16 was widely reported last month, when thousands of people signed a petition in protest. But official guidance has revealed that a chapter on the periodic table will be cut, too, along with other foundational topics such as sources of energy and environmental sustainability. Younger learners will no longer be taught certain pollution- and climate-related topics, and there are cuts to biology, chemistry, geography, mathematics and physics subjects for older school students.

"Have you any idea how much tyrants fear the people they oppress? All of them realize that, one day, amongst their many victims, there is sure to be one who rises against them and strikes back!"

Apple Customers Say It’s Hard to Get Money Out of Goldman Sachs Savings Accounts

Apple’s savings account, a partnership with Goldman Sachs, launched in April to great fanfare. Some customers say it has been hard to get their money out. Customer service representatives at Goldman, which holds the deposits, sometimes gave differing responses about what to do, they said. Sometimes, custumers' money appeared to have simply vanished, not showing up in their Apple account or in the account they were trying to move it to.

The BRICS nations, consisting of Brazil, Russia, India, China, and South Africa, are actively seeking to expand their alliance by inviting

The BRICS nations, consisting of Brazil, Russia, India, China, and South Africa, are actively seeking to expand their alliance by inviting additional countries like Saudi Arabia and the UAE to join, forming what is referred to as BRICS+. Furthermore, there have been discussions within the group about the possibility of creating a shared currency called BRICS.

The European Union (EU) has formally signed new legislation on crypto licensing and money laundering rules into law.

New regulations include that crypto exchanges and wallet providers looking to operate across the 27-nation bloc will be able to do so with a license issued under MiCA, which will likely be truly enforced in June after being published in the official EU journal. However, critics argue that excessive regulations could stifle innovation and drive crypto businesses away from the EU.

He [Robert Kennedy Jr.] also criticized the inevitability of central bank digital currencies, or CBDCs, which he fears the U.S. government may weaponize for financial surveillance. He drew parallels to what happened to the 2022 Ottawa truckers, who had facial recognition technology deployed against them to log their identities.

"They had people going out looking at the license plates, facial recognition, and doing data mining on these people to find out who they were, and then shutting down their bank accounts, so they couldn’t pay their mortgages, they couldn’t pay their alimonies, they couldn’t pay for food for their families and children," he said. "If a government has that power, it can turn us all into slaves overnight."

"If they can get you out of your home cause you can’t pay your mortgage or your rent, and if they can starve you, most people are going to comply," he added.

Robert F. Kennedy Jr. Says He Doesn’t Want ‘Anti-Crypto’ People on the US Securities and Exchange Commission

"At most, they should be neutral, and we should have people on there who are from the crypto community," he said.

"[The] SEC’s function now is not to protect the American people, but it’s to protect the banks – particularly the central banks and those interests," Kennedy said. The presidential candidate also spoke about the impact of inflation [...], saying that digital assets presented an "exit ramp" for those worried about traditional money being misused in the name of foreign wars or bailing out big banks.

Another dormant crypto wallet awakens after 8 years, moving ETH worth almost USD 15 million

An Ethereum ICO participant who has been dormant for 8 years woke up today. He transferred all 8000 $ETH($14.7M) to a new address. https://etherscan.io/address/0x6ccb03acf7f53ce87aadcc21a9932de915f89804

This has been happening quite often over the recent few months. Why?

In the current case, which has been observed and reported by Lookonchain, a participant in Ethereum's ICO has moved holdings to another wallet address, also with a very short transaction history.

Here is the data from the Ethereum explorer: https://web.archive.org/web/20230527172457mp_/https://etherscan.io/address/0x6ccb03acf7f53ce87aadcc21a9932de915f89804

Crypto firm Unbanked shuts down and urges users to withdraw balances, says US regulations prevented fundraising

Unbanked, a cryptocurrency card and trading platform, said on May 25 that it will wind down its services due to harsh U.S. regulations.

The firm asserted that regulators in the U.S. are “actively trying to stop companies (banks and fintechs) from supporting crypto assets – even when the companies are trying to do it correctly and by the book”. Unbanked said it recently signed a term sheet for a $5 million investment with a $20 million valuation. Though it did not state which regulations prevented it from receiving the loan, it said it ultimately had not received the funds as of yet and will resume operations.

CEO of Crypto Hardware Wallet Ledger concedes that governments could subpoena access to user funds, but says it is not a concern

Ledger CEO Pascal Gauthier said that the ability for governments to subpoena user funds if they use the Recover service is the only concern.

Recent comments by Ledger shareholder and former CEO Éric Larchevêque that governments could subpoena access to user funds held on a Ledger device that has subscribed to its new Recover service sparked consternation among Ledger users. Now Ledger's current CEO Pascal Gauthier has shrugged off concerns, arguing that governments only issue subpoenas in the case of a serious act like terrorism or one involving drugs. "It's not true that the average person gets subpoenaed every day."

Aha.

Broker commission in retail financials services damages household wealth by 375 million euros annually, study finds

Household wealth in countries with commission bans grows significantly more than in countries without commission bans, a research team from the University of Regensburg claims. They measured the difference in returns at 1.7 percent p.a. The researchers call lawmakers in countries like Germany, where the loss amounts to 2,400 euros per household per year, to ban commission-based sales of financial products.

In the recent past, Denmark, Finland, the UK, the Netherlands, Norway as well as Australia and New Zealand have introduced such bans and established alternative payment methods, e.g., according to advisory time or assets under management.

Here is the study: https://epub.uni-regensburg.de/54281/

China has created its own subprime infrastructure crisis, and now it is trying to bail itself out

China has been bailing out risky loans it made for its Belt and Road Initiative, new research shows. The U.S. should see an opportunity, writes Elaine Dezenski.

China’s Belt and Road Initiative (BRI) made high-risk, often-unneeded billion-dollar infrastructure loans, with no conditionality, poor risk planning, shrouded in opacity and secrecy. Cash-poor developing countries that lacked the ability to pay were particularly vulnerable, a report says. The seeds of project failure were sown from the outset by a lack of transparency, risk management, and viable controls to check corruption and incompetence.

UK: Majority of gig economy workers earn below minimum wage, study says

52% of those doing jobs ranging from data entry to food delivery are earning below the minimum wage, a study by University of Bristol finds. Average wages are £8.97 per hour – around 15% below the current UK minimum which rose to £10.42 in May. Three out of four workers say they are experiencing work-related insecurity and anxiety.

According to onchain data, a bitcoin whale address transferred 2,071.5 bitcoin, worth approximately $60 million, after remaining dormant since December 19, 2013. Interestingly, this bitcoin address is linked to two wallets that sent 10,000

Our motives for classifying animals may be more about guilt than curiosity.

"We are in an age which, to an extent, embraces feminism, anti-racism and anti-ableism. Perhaps it is also time to include “speciesism” in our discussions about ethics – since valuing some species over others is a form of prejudice."

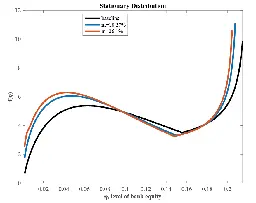

A financial model investigating the issuance of digital money as central bank digital currency (CBDC) or as stablecoins found that a fully-integrated digital currency would lead to higher and less volatile asset prices, and household welfare gains are potentially large which could lead to an increas...

Cross-posted from https://beehaw.org/post/344431

Digital currency lowers asset price volatility and increases household welfare, but poses risks to banks, researchers say

Digital currencies provide a potential form of liquidity competing with bank deposits. We introduce digital currency into a macro model with a financial sector in which financial frictions generate endogenous systemic risk and instability. In the model, digital currency is fully integrated into the ...

A financial model investigating the issuance of digital money as central bank digital currency (CBDC) or as stablecoins found that a fully-integrated digital currency would lead to higher and less volatile asset prices, and household welfare gains are potentially large which could lead to an increase in consumption by up to 2%.

However, a fully-integrated digital currency would depress bank deposit spreads, particularly during times of crises, which limits the banks’ abilities to recapitalize losses after a bank crises. These investment losses, not specifically bank runs, create instability, the paper argues.

Another research paper found that bank runs are not as big as initially feared. This paper can be found here: https://www.financialresearch.gov/working-papers/2022/07/11/central-bank-digital-currency/

Both papers focus on the issuance of CBCD and stablecoins and do not include privately issued money like LETS/Time Dollars and similar privately issued complementary currency systems.

(Edited to correct a typo.)

Having faced extinction 50 years ago, India's tigers are back again

Efforts to revive India’s tiger population began 50 years ago over fears the big cats were going extinct.

From 2006 to 2018, the tiger numbers almost doubled to 2,967 and are now well above 3,000, according to the recently released census in India, home to 70 percent of the world’s tigers. Indian PM Narendra Modi also launched the 'International Big Cats Alliance', which will focus on the protection of seven big cat species: the tiger, lion, leopard, snow leopard, puma, jaguar and cheetah.

USA: New Texas Bill would introduce digital currency backed by gold

As America faces the twin threats of inflation and bank failures, three U.S. congressmen introduced a pivotal sound money bill that would enable the Federal Reserve note “dollar” to regain stable footing for the first time in more than half a century. Rep. Alex Mooney (R-WV) - joined by Reps. Andy B...

Federal Reserve notes would become fully redeemable for and exchangeable with gold, with the U.S. Treasury and its gold reserves backstopping Federal Reserve Banks as guarantor. Historians have long been criticizing that the elimination of gold redeemability from the monetary system freed central bankers and federal government officials from accountability when they expand the money supply, fund government deficits though trillion-dollar bond purchases, or otherwise manipulate the economy.

Spanish hunting fair glorifies the slaughter of imperiled wildlife despite 89% of the public opposing trophy hunting

MADRID—Humane Society International/Europe found that at least 54 outfitters at one of EU’s largest hunting fairs, Cinegética, were selling trophy...

The species whose lives were offered up for sale include polar bears, lions, African elephants and leopards wrapped up in special holiday packages offered at relatively low prices, like 900 euros for a giraffe and 4,500 euros for a hunt to kill a female lion—including international flights and 7-day accommodations.