I found this to be a pretty good start: https://theactivistinvestor.com/The_Activist_Investor/How_to..._files/Activist%20Investing.pdf

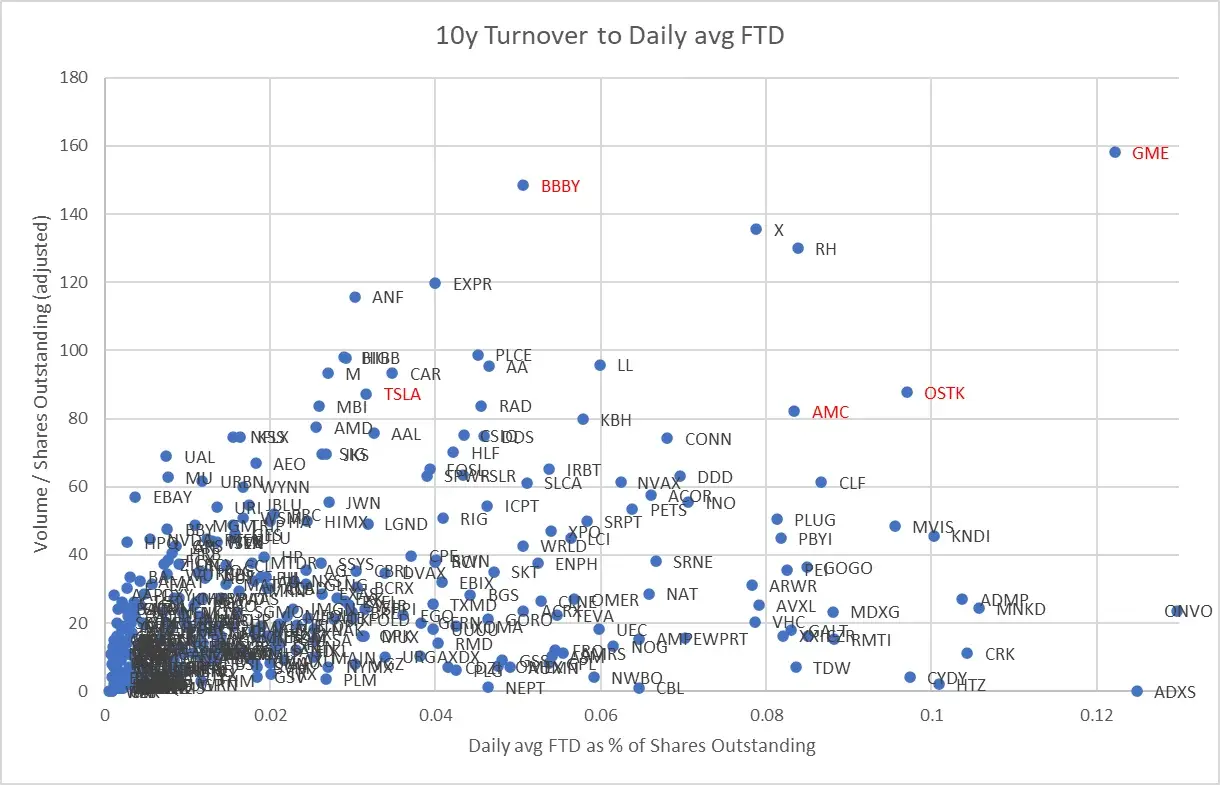

Thank you. Yes total volume for 10y and avg daily FTD for the same period. A very good question! See:

- https://www.reddit.com/r/Superstonk/comments/wursjt/gme_outstanding_shares_turnover_compared_to_msft/

- https://www.reddit.com/r/Superstonk/comments/wlrdlk/previous_research_found_that_tsla_and_bdlp_had/

Indeed GME was always on the top, but became the outlier during the sneeze in terms of volume. If I would redo the graph I think BBBY would have a similar position.

GME is certainly an outlier over 10y. One of a few. If one looks in specific years GME looks rather normal in this group of 300-400 outliers.

So, yes, GME is probably sold many times the outstanding shares, but so are a lot of other stocks, too.

Though, not many have RC.

Shorts R US - The Geoffrey Files Part 3 - The reports of Geoffreys nearing death might be actually true - Doug Cifu trades “nice” in September, only (a) month(s) in run way, death trigger in place

Repost from beginning of November.

Edit 2023-11-22: I might have missed something. Interestingly, in the new Teddy vol 2 TOYS is shown... might it actually be a trap for shorts?

End edit.

Original title: Shorts R US - The Geoffrey Files Part 3 - The reports of Geoffreys nearing death might be actually true - Doug Cifu trades “nice” in September, only (a) month(s) in run way, death trigger in place, management with risk free compensation?!

I just went quickly through the annual report of TOYS R US (see https://wcsecure.weblink.com.au/pdf/TOY/02734815.pdf where all further references without additional link are for) and wow... this doesn't look good from a financial perspective. Wow... I have to share what I found.

Please remember, do your own due diligence. I am no financial adviser and this is not financial advice.

TL;DR: This company is borderline (a trap?), Doug Cifu trades “nice” in September, equity lowered by 96% or $32m, 1.7 months in run way (time till out of money) at the time of the annual report, debt increased and shifted to very short term debt, whole management receives mainly risk free compensation.

Topics:

- There is no float, Neo.

- Doug Cifu trades “nice” in September

- More debt, less equity

- Only (a) month(s) in run way (as of annual report)

- So, wen profitable?

- Who owns the debt? A death trigger?

- What about their US comeback?

- Execs with risk free compensation

There is no float, Neo.

Please check back on Part 1 (ppsub) and Part 2 (ppsub) if you haven’t. This also mixed with the info from the annual report that the top 20 holders own 72% of the shares.

(p. 89)

Okay, if this is all a sign of high short interest, is this a bullish sign? We know of certain activist investors that they like leaders to put their money where their mouth is, that risk free compensation probably will not lead to the best outcome for the company. And we know that shorts like to put a company to bankruptcy. So lets shortly go through some parts of the annual report and see how it looks like. Feel free to correct me and point out any important things I missed or got wrong.

Also is there some way the debt could be turned to something good like supposedly in BBBY with the NOLs?

Doug Cifu trades “nice” in September

Market Statistics - Monthly Share Volume (finra.org)

Why should he do this? Ah, remember his meltdown on X? Maybe it’s rather the same impulse which lead him to do this… maybe not.

More debt, less equity

What blew my mind was on page 6. Leverage blew through the roof. From a moderate debt/equity ratio of 29% to 831% from FY22 to FY23

What did they do?

The balance sheet is a total mess… cash is gone, equity is nearly gone. Their borrowings went up.

(p. 28)

And it widened to $54m in two years.

(p. 29)

(p. 73)

Build up debt, scale down assets… the new key to success?

Also exchanging long term debt for higher interest rate short term debt, right?

(p. 76)

So they surely have massive countermeasures in place, right? They have massive countermeasures in place, right?

Oh nice… so during the course of one year the equity went down 96% or $32m while taking on $15.8m additional debt. Now their plan is to get rid of the UK business which will reduce loss by $6m, which brought in $5.3m. Wtf?

They are loosing roughly $1m/month (while operating activities might be seasonality).

Only (a) month(s) in run way (as of annual report)

So what is the financial runway left? (Total Capital ÷ Monthly Operating Expenses = Runway)

1,766 / (12,465 / 12) = 1.7 months

Wow.

So, wen profitable?

(p. 8)

(p. 2)

Breakeven by 2025? How do they want to survive with such high short-term debt, risk-free compensation and high burn rate?

Who owns the debt? A death trigger?

(p. 9)

(p. 63)

Ah, there is a death trigger.

The lender seems to be TRU Kids Inc (TRUK). See p. 71. If someone wants to dig in.

Losses as an asset?

(p. 63)

What about their US comeback?

In short... no.

(p. 68)

Execs with risk free compensation

(p. 18)

(https://wcsecure.weblink.com.au/pdf/TOY/02688802.pdf)

Edit: as of 17.11. Pen Cox got granted vested 14.5m shares. For a price of $0.011 AUD thats 160k AUD vested over the next years.

Well you could argue that the 40-80% variable Renumeration might be risk based, but there is no clear indication it will be.

There is no huge stock package with vested options and she gets roughly the same base as Matt Furlong got at GME for comparison.

This ends with: I would recommend for everyone to READ THE ANNUAL REPORT (https://wcsecure.weblink.com.au/pdf/TOY/02734815.pdf), dig into the available information.

Let’s be a step or two ahead of shorts. Imagine finite supply and unfiltered demand would define the price, the stock market is a self-custodial defi blockchain, what options are left for shorts?

origin: https://lemmy.whynotdrs.org/post/429107

> TL;DR: As seen in Blurring DD part 3 a free and fair market will be on a self-custodial defi blockchain (link see below) which needs to be built on an open source platform. This will render nearly everything in the short toolkit useless. Stocks will no longer behave like infinite fiat money supply where you can always borrow more, but rather a finite share of a company. One thing left to them are (meme) stock traps. We have to begin understanding them. The DD has just begun. > > Topics: > - A really free and fair market > - How would shorting work in such a market? > - Comparing todays short technics with those in a free and fair market > - What is left for shorts and how can we be one or two steps ahead? > > # A really free and fair market > > First I want to thank the team of DRS GME, especially chives who went through several iterations of the post with me. I started writing it in mid 2022 and happy to share the thoughts now. > > ! > > Counterfeit Shares 2.0 lists a lot of ways to create a counterfeit share. During the last years we got ample evidence that this is how the stock market operates (see last DD https://lemmy.whynotdrs.org/post/331876/). Looking at the loopring whitepaper (https://loopring.org/resources/en_whitepaper.pdf) and imagine a stock exchange based on self-custodial wallets and decentralized exchanges there eventually cannot be counterfeit assets, given certain conditions (see below). In this environment Fails to Deliver, Settlement Fails, Wrong labeling, False Locates, Naked Options and Perpetual Rolling may not occur. For context this is all about the loopring technology based on Etherium and not about their token (LRC). > > As main condition everyone would have to use the particular uncompromised platform. E.g. the loopring wallet app for iPhone or Android, again not talking about LRC as a token here. If on the opposite every broker kept its own platform and would pinky promise to connect to the Loopring backend, we could probably end up in the same situation as today. Brokers could internalize orders or route to only certain exchanges. So how to solve this? A) only allow "Loopring App" for holding and trading shares B) implement authenticity checks at B1) shareholder interactions, like voting B2) other purposes, like interacting with products of the company (e.g. the Twitter Account would connect with your wallet and show the amount of shares you own). > So this as an example for the "ownership" part (see also the DD about ownership here (https://lemmy.whynotdrs.org/post/331878), for the exchange part solution A would solve the issue, B maybe. A graphical overview of those stages: > > ! > > We will go on in this post mostly assuming the green path would take the majority of shares and orders (aka “free and fair market”). > > # How would shorting work in such a market? > > Here is a thought experiment on how shorting could work in such a free and fair market. > Let’s say realGME was the token of the company and wrappedGME the derivative which you get instead of realGME when lending your share. > > Here is a thought experiment on how shorting could work in such a free and fair market. > Let’s say realGME was the token of the company and wrappedGME the derivative which you get instead of realGME when lending your share. > > 1) If you buy a tokenized stock you would always know that realGME is the one which is a real share, always with 1:1 voting rights and 1:1 rights of 1/(shares outstanding) of the company, always. > 2) A buyer would therefore only buy realGME, not some wrappedGME (this is very different today with e.g. EU brokers going to EU exchanges and only offering GS2C instead of GME). > 3) A shortseller would then need to somehow get realGME which he needs to sell to a buyer, he could not sell wrappedGME. Yes, you could maybe fuck around with the derivative wrappedGME, but you could not with realGME - thus any buyer always gets a real share, the lender may be cheated, true. So the lender should know the risk when getting wrappedGME. Today lenders and buyers are cheated. Also the (short-term) negative price pressure on realGME would still be there. Keep this in mind for now. > 4) The new buyer becomes owner of the realGME with its voting and economic rights on the company attached, no one can take the realGME from him by whichever force. > 5) The old owner who gave his share away to shortsellers receiving a wrappedGME which only signals the ownership rights on a realGME, but losing his voting and economic rights - the old owner got a derivative, which is clear at the time. > > So the ownership right is clear in every second of this transaction. This is fundamentally different than today. > And now to make this system work we would need: > > 6) wrappedGME could be provided by a smart contract which holds collateral from the short seller (e.g. ETH or some kind of USD). > 7) the short seller can either buy back a realGME and exchange it for wrappedGME or in case of a "margin call" the smart contract will automatically buy back realGME and do the exchange. > > 7b) for this to work the margin call would always be below the value of the collateral. > > 7c) still, in extreme situations when the price of realGME is higher than the value of the collateral a buy back is not possible. Then the old owner would lose the realGME and receive the collateral instead. > > 7d) we'd likely see a huge number of variants in how collateral is paid, upon which terms, etc. > > In short: shorts would still pretty much work, maybe even better than today. But it forces more honesty between two people or entities making a deal. > > # Comparing todays short technics with those in a free and fair market > > However, there are many more tactics to influence a stock price and we will dive into each and look whether the whitepaper provides a solution. > > ! > > Or in short: > > ! > > # What is left for shorts and how can we be one or two steps ahead? > > Man, such a free and fair market would be something I am really scared of if I had a lot of naked shorts in nearly every stock on the planet. This would indeed something, shorts never forget. > Since its also a few years that individual investors theorized such a system for GME, there is no way shorts haven’t been doing this for some years now. And while there might be countermeasures from shorts in the political, regulatory, behavioral and so many different corners, we will just look at their usual techniques and see what’s left. So the three main things which work independently of a free and fair market are pumps & dumps, poops & scoops, short & distort. Let’s call them traps. > > > ! > > So if they cannot beat individual investors by their normal tactics they have to probably level up on what’s left. Ah, and make no mistake also institutional investors are being played. Don’t forget, this is a game of longs vs naked shorts. > > > ! > > Now, to be one step ahead, we should discuss exactly the matter of this post. We know about GME pretty well, but we can only direct register every share once, so probably the question in which stock to invest is a pretty important questions. Maybe also some might want to become activist investors themselves. Therefore, to be two steps ahead we should already begin to understand short traps (where a subset is surely “meme traps”). And I imagine this is game where we never finish learning. Let’s begin. > > > Sources > https://www.reddit.com/r/Superstonk/comments/v20yqz/best_tldr_of_this_whole_saga_by_ujgatprime/ (I really recommend you to look through the comments of JG-at-Prime) > https://web.archive.org/web/20210131131256/http://www.counterfeitingstock.com/CS2.0/CounterfeitingStock20Full.pdf > https://loopring.org/resources/en_whitepaper.pdf >

Let’s be a step or two ahead of shorts. Imagine finite supply and unfiltered demand would define the price, the stock market is a self-custodial defi blockchain, what options are left for shorts?

TL;DR: As seen in Blurring DD part 3 a free and fair market will be on a self-custodial defi blockchain (link see below) which needs to be built on an open source platform. This will render nearly everything in the short toolkit useless. Stocks will no longer behave like infinite fiat money supply where you can always borrow more, but rather a finite share of a company. One thing left to them are (meme) stock traps. We have to begin understanding them. The DD has just begun.

Topics:

- A really free and fair market

- How would shorting work in such a market?

- Comparing todays short technics with those in a free and fair market

- What is left for shorts and how can we be one or two steps ahead?

A really free and fair market

First I want to thank the team of DRS GME, especially chives who went through several iterations of the post with me. I started writing it in mid 2022 and happy to share the thoughts now.

Counterfeit Shares 2.0 lists a lot of ways to create a counterfeit share. During the last years we got ample evidence that this is how the stock market operates (see last DD https://lemmy.whynotdrs.org/post/331876/). Looking at the loopring whitepaper (https://loopring.org/resources/en_whitepaper.pdf) and imagine a stock exchange based on self-custodial wallets and decentralized exchanges there eventually cannot be counterfeit assets, given certain conditions (see below). In this environment Fails to Deliver, Settlement Fails, Wrong labeling, False Locates, Naked Options and Perpetual Rolling may not occur. For context this is all about the loopring technology based on Etherium and not about their token (LRC).

As main condition everyone would have to use the particular uncompromised platform. E.g. the loopring wallet app for iPhone or Android, again not talking about LRC as a token here. If on the opposite every broker kept its own platform and would pinky promise to connect to the Loopring backend, we could probably end up in the same situation as today. Brokers could internalize orders or route to only certain exchanges. So how to solve this? A) only allow "Loopring App" for holding and trading shares B) implement authenticity checks at B1) shareholder interactions, like voting B2) other purposes, like interacting with products of the company (e.g. the Twitter Account would connect with your wallet and show the amount of shares you own). So this as an example for the "ownership" part (see also the DD about ownership here (https://lemmy.whynotdrs.org/post/331878), for the exchange part solution A would solve the issue, B maybe. A graphical overview of those stages:

We will go on in this post mostly assuming the green path would take the majority of shares and orders (aka “free and fair market”).

How would shorting work in such a market?

Here is a thought experiment on how shorting could work in such a free and fair market. Let’s say realGME was the token of the company and wrappedGME the derivative which you get instead of realGME when lending your share.

Here is a thought experiment on how shorting could work in such a free and fair market. Let’s say realGME was the token of the company and wrappedGME the derivative which you get instead of realGME when lending your share.

- If you buy a tokenized stock you would always know that realGME is the one which is a real share, always with 1:1 voting rights and 1:1 rights of 1/(shares outstanding) of the company, always.

- A buyer would therefore only buy realGME, not some wrappedGME (this is very different today with e.g. EU brokers going to EU exchanges and only offering GS2C instead of GME).

- A shortseller would then need to somehow get realGME which he needs to sell to a buyer, he could not sell wrappedGME. Yes, you could maybe fuck around with the derivative wrappedGME, but you could not with realGME - thus any buyer always gets a real share, the lender may be cheated, true. So the lender should know the risk when getting wrappedGME. Today lenders and buyers are cheated. Also the (short-term) negative price pressure on realGME would still be there. Keep this in mind for now.

- The new buyer becomes owner of the realGME with its voting and economic rights on the company attached, no one can take the realGME from him by whichever force.

- The old owner who gave his share away to shortsellers receiving a wrappedGME which only signals the ownership rights on a realGME, but losing his voting and economic rights - the old owner got a derivative, which is clear at the time.

So the ownership right is clear in every second of this transaction. This is fundamentally different than today. And now to make this system work we would need:

- wrappedGME could be provided by a smart contract which holds collateral from the short seller (e.g. ETH or some kind of USD).

- the short seller can either buy back a realGME and exchange it for wrappedGME or in case of a "margin call" the smart contract will automatically buy back realGME and do the exchange.

7b) for this to work the margin call would always be below the value of the collateral.

7c) still, in extreme situations when the price of realGME is higher than the value of the collateral a buy back is not possible. Then the old owner would lose the realGME and receive the collateral instead.

7d) we'd likely see a huge number of variants in how collateral is paid, upon which terms, etc.

In short: shorts would still pretty much work, maybe even better than today. But it forces more honesty between two people or entities making a deal.

Comparing todays short technics with those in a free and fair market

However, there are many more tactics to influence a stock price and we will dive into each and look whether the whitepaper provides a solution.

Or in short:

What is left for shorts and how can we be one or two steps ahead?

Man, such a free and fair market would be something I am really scared of if I had a lot of naked shorts in nearly every stock on the planet. This would indeed something, shorts never forget. Since its also a few years that individual investors theorized such a system for GME, there is no way shorts haven’t been doing this for some years now. And while there might be countermeasures from shorts in the political, regulatory, behavioral and so many different corners, we will just look at their usual techniques and see what’s left. So the three main things which work independently of a free and fair market are pumps & dumps, poops & scoops, short & distort. Let’s call them traps.

So if they cannot beat individual investors by their normal tactics they have to probably level up on what’s left. Ah, and make no mistake also institutional investors are being played. Don’t forget, this is a game of longs vs naked shorts.

Now, to be one step ahead, we should discuss exactly the matter of this post. We know about GME pretty well, but we can only direct register every share once, so probably the question in which stock to invest is a pretty important questions. Maybe also some might want to become activist investors themselves. Therefore, to be two steps ahead we should already begin to understand short traps (where a subset is surely “meme traps”). And I imagine this is game where we never finish learning. Let’s begin.

Sources https://www.reddit.com/r/Superstonk/comments/v20yqz/best_tldr_of_this_whole_saga_by_ujgatprime/ (I really recommend you to look through the comments of JG-at-Prime) https://web.archive.org/web/20210131131256/http://www.counterfeitingstock.com/CS2.0/CounterfeitingStock20Full.pdf https://loopring.org/resources/en_whitepaper.pdf

REPOST: Unfinished Stonk Overview for Days /w FTD, 10y Turnover (volume/outstanding shares), daily avg FTDs (as % of shares outstanding)

Awesome WHYDRS team. Thanks for your work!

I feel this work is early, but spot on. GameStop can set the precedent for household investors waking up, realizing how the market works and with DRS have a relatively easy way to really impact the market.

As the question bothered me if GameStop is such an outlier or more or less business as usual, I gathered data and did some graphs. I never really finished or published them, cause I feel that still with GameStop and DRS we are testing an hypothesis and the result is still to be seen (successful business & high DRS & huge shorts should positively corelate with the price). Why start DRSing other stocks if the impact of the "biggest DRSing community" is still not really proven. At the same time, if the hypothesis proofs to be right, other stocks will follow.

However, I feel that here might be the place to share the drafts for Days /w FTD, 10y Turnover and daily average FTDs (as % of shares outstanding). I also did some other analysis, like price elasticity. This is not financial advice, also please proof and test the numbers, I might have made errors.

Sources:

- For Days with FTD and daily FTD the SEC data was used: https://www.sec.gov/data/foiadocsfailsdatahtm

- For Shares Outstanding the SEC API was used: https://data.sec.gov/api/xbrl/companyconcept/[CIK]/DEI/EntityCommonStockSharesOutstanding.json (where the CIK of the ticker is derived from https://www.sec.gov/Archives/edgar/cik-lookup-data.txt)

- The Volume was fetched using yahoo finance

- All data was curtailed for 2012 to 2022 (Q3), so about 10 years

- ETFs were filtered out

- Only the top ~400 tickers as of days with FTDs were used

10y Turnover (volume / shares oustanding) to Daily avg FTD

Days with FTD and daily avg FTDs as % of Shares Outstanding

Same as above but zoomed out

The work was inspired by u/sdfprwggv . Thanks! Even if I didn't finish the work - maybe someone wants to continue.

Could also provide the source. Everything was written in Python.

Thank you jersan! I 90% agree with your comment. From the outside it looks like an unprofitable business, though sitting on a pile of cash only offering lofty promises. Once GME is profitable it will be easier to onboard new investors and also encourage old investors.

To the "explode" part rather want to stress that another main point of my post is: DRS is not enough. Not enough for what? Like I wrote in my post about price elasticity (https://lemmy.whynotdrs.org/post/206100 or https://www.reddit.com/r/whydrs/comments/16ijwv0/tales_of_the_death_of_the_liquidity_fairy_price/) I think there are two levels:

- Level 1: Disruptive price adjustment to valuation

- Level 2: MOASS with real price discovery and the closing of naked shorts

With the current system of stock market exchanges no matter what the company does, it is very unlikely we see level 2. The price might be adjusted for Level 1, but shorts won't close. They rather will hedge and make even more money with derivatives.

If you think otherwise, try to dig into the "Tesla shortsqueeze" and check who actually lost, which hedge fund had to be closed because of the closing of naked shorts.

You mean how the former GameStop CFO fkd up the splividend and kind of allowed the DTC to handle it as a normal split? (See: https://www.reddit.com/r/FWFBThinkTank/comments/14p3fmp/deep_dive_into_how_the_dtcc_and_brokers_handled/)

He left GME immediately and returned to Amazon.

Did the old Transfer Agent let you know in advance?

Blurring: "Massive naked short positions need to be looked upon as huge assets." (2004) Where we are and what lies ahead. (1/3)

Special thanks go out to jackofspades, Bibic-jr, Chives, 6days1week and lawsondt for their contribution and support. Love you guys.

PREFACE – A quick little short squeeze

SOME OF THE GREAT DD AND ITS CONNECTION TO GAMESTOP AND THE STOCK MARKET

HOW LONGS WIN THIS WAR – SOMETHING THEY WILL NEVER FORGET

- What is a share and where is it held?

- How many entities technically have access to a share?

- Where are the shares traded and how is the price derived?

- How regular people think price discovery works and how it actually works?

WHAT NEEDS TO CHANGE FOR A FAIR MARKET

PREFACE – A quick little short squeeze

GameStop is what brought most of us here. I wasn’t really into GameStop and had experienced the short attacks and FUD on Tesla. So as Musk tweeted GameStonk!! [https://twitter.com/elonmusk/status/1354174279894642703] and Ihors3 with SI partners reported like 140% short interest [https://twitter.com/ihors3/status/1354477089471295492], I thought I had one short squeeze but how about a second one? A quick litte short squeeze cannot be wrong, can it?

I checked RC and Chewy and I thought I knew what I was doing clicking buy on my neo brokers interface. I thought I knew roughly how the market worked. I had shares before. I mean I thought I bought shares of US companies on the stock exchange.

Boy, I had no idea…

Credit to u/Mousiaris

So the price shot up and we won … oh no, actually brokers canceled the buy button for many stocks (https://twitter.com/magsonthemoon/status/1697231772252045333), the media tried to convince us that shorts closed (https://twitter.com/ihors3/status/1356261806612885509) and demonstrated that individual investors could never win in the current system.

And Just looking at the FTDs, volume, institutional ownership there are hundreds or even thousands of companies where the price is wrong (https://www.reddit.com/r/whydrs/comments/13ckpsz/unfinished_stonk_overview_for_days_w_ftd_10y/).

SOME OF THE GREAT DD AND ITS CONNECTION TO GAMESTOP AND THE STOCK MARKET

We learned from the Amazon Bust Out Scheme ™ (http://web.archive.org/web/20210601141915/https://www.reddit.com/r/Superstonk/comments/np33hr/amazon_bain_capital_and_citadel_bust_out_the/) that cellar boxing (https://investorshub.advfn.com/boards/read_msg.aspx?message_id=2543759) can be helpful to scoop up assets very cheaply. So big companies (like Amazon), lending banks, DTCC, shorts, corrupt board members, overpriced consultants, lawyers and corrupt politicians all profit from this.

The ones who lose are the bankrupted company, the employees who lose their job and of course us, individual investors.

Looking back to 2020 GameStop ticked all the cellar boxing boxes (https://www.reddit.com/r/Superstonk/comments/1663z0n/comment/jyhpdw5/):

- incompetent (and/or) fraudulent management with a losing strategy (https://www.sec.gov/Archives/edgar/data/1326380/000101359420000821/rc13da3-111620.pdf),

- which applied a 10% $216m debt during COVID (https://www.sec.gov/Archives/edgar/data/1326380/000132638021000032/gme-20210130.htm) while losing money since 2018 (smells like death spiral financing),

- bad press and

- a steadily declining share price from $44 2015 to under $4 2020 (pre-split) accompanied by huge volume (https://www.reddit.com/r/Superstonk/comments/wursjt/gme_outstanding_shares_turnover_compared_to_msft/), high institutional ownership and massive Failure to delivers (https://www.reddit.com/r/Superstonk/comments/wlrdlk/previous_research_found_that_tsla_and_bdlp_had/).

This stock market is designed this way. Individual investors don’t own stock, we got beneficial rights (https://www.whydrs.org/why-register-shares) where with many, especially international brokers you can’t even vote or votes are cut due to over-voting (https://cdn.ymaws.com/stai.org/resource/collection/1DEFBE7C-390F-4D83-AE14-99E53B32892E/2019.12.3_SEC_letter_re_Proxy_concept_release.pdf). With naked shorts broker-dealers collect 100% of the profit while giving out counterfeit shares, keeping everything in case the company goes bust (https://finance.zacks.com/tax-stocks-exchanged-through-merger-acquisition-11818.html). And this is not one stock, this is the stock market (https://www.reddit.com/r/whydrs/comments/13ckpsz/unfinished_stonk_overview_for_days_w_ftd_10y/).

I strongly believe a lot of the over 180.000 long-term DRSd individual investors are here for system change. To stop this unfair and corrupt market. Like Elon said, he didn’t start the fight with the SEC but he will finish it (https://twitter.com/elonmusk/status/1496564151493304324). So we will with predatory short sellers.

Part 2: https://lemmy.whynotdrs.org/post/331878

Blurring: "Massive naked short positions need to be looked upon as huge assets." (2004) Where we are and what lies ahead. (2/3)

PREFACE – A quick little short squeeze

SOME OF THE GREAT DD AND ITS CONNECTION TO GAMESTOP AND THE STOCK MARKET

HOW LONGS WIN THIS WAR – SOMETHING THEY WILL NEVER FORGET

- What is a share and where is it held?

- How many entities technically have access to a share?

- Where are the shares traded and how is the price derived?

- How regular people think price discovery works and how it actually works?

WHAT NEEDS TO CHANGE FOR A FAIR MARKET

HOW LONGS WIN THIS WAR – SOMETHING THEY WILL NEVER FORGET

But how can longs win over shorts? Is a successful turnaround enough? Did for example naked shorts bleed with the Tesla meteoric rise in share price or did they just switch sides and end up earning even more money? Is pure DRS enough? How is the system working today anyway and what needs to change?

To answer those questions we will dive in:

-

What is a share and where is it held?

-

How many entities technically have access to a share?

-

Where are the shares traded and how is the price derived?

-

How regular people think price discovery works and how it actually works?

-

What is a share and where is it held?

A share of a company consists of voting and economic rights. Vote on the annual meeting and thus have direct influence of who runs the company and indirect to the strategy and organization

Economic right is the right to own and you would think also to buy and sell. But the right to buy and sell is not attached to a share but rather in combination with an exchange and a broker-dealer, e.g. the right to buy was removed per brokers during January 21 and in general with places like “the expert market”, where only a few brokers allow individual investors to buy, while one can sell anytime. Also some brokers (maybe the minority) allow one to select an exchange or OTC to place your order while some don’t.

Like with money you can decide where to hold your shares. Money can be held as hard cash in your wallet, in a bank account or even be invested and held in a derivative (e.g. overnight money). Thus, when giving the money to another party it becomes clear that they are technically able to do something with it, e.g. loan or invest it. This could technically be done without your consent, which might be legally required or not. So the next question is when changing the way to hold an asset (money or shares) how many entities have technically access to it.

- How many entities technically have access to a share?

The place the share is held also defines how many entities technically have access to the share. Legally that’s a different story, but see with a broker-dealer you are holding an entitlement as beneficial owner. For Transfer Agent Regulations the SEC called for comments on transfer agent regulation in 2015, since current regulations are from 1977 (https://public-inspection.federalregister.gov/2015-32755.pdf, p. 1) . Obviously, no regulation was put into action and there is rather no action and meetings since 2019. Looking at what the SEC already state in 2015 is that shares maybe not safe with a transfer agent and issuer plan are typically not in the name of the investor (p. 194 and https://www.sec.gov/about/reports-publications/investor-publications/holding-your-securities-get-the-facts). Bibic-jr created this wonderful graph in showing the differences in the ways of holding shares:

Yet, it bugged me that all of those ways include at least one counterparty who technically has access. So I added one more step and compared the amount of entities having technical access with Money, Crypto and Shares:

Who should have access to your equity? Here's how to hold for your preference:

Wait a minute… so DRS is not the way? Indeed, it’s the only way. DRS and DWAC transfers into Direct Registration might be the only way out of this fraudulent system.. Still, one entity beside you always has access and could in theory also remove the buy button. Can MOASS happen with another entity having access? I don’t know and I repeat, without DRS we are stuck in the system with DTC.

Some may also ask, wait but Plan is equal to Pure DRS isn't it? Well the SEC said "[t]o hold in DRS once [plan shares] are acquired, you would need to instruct the transfer agent to move the securities from the issuer plan to DRS" (https://www.sec.gov/about/reports-publications/investor-publications/holding-your-securities-get-the-facts), since share plans (dividend reinvestment, direct stock purchase, etc.) could not be considered your property (https://www.sec.gov/comments/s7-27-15/s72715-40.pdf, p.12). Also finra says that “[y]ou’ll need to instruct the transfer agent to move [bought plan shares] to the DRS” https://www.finra.org/investors/insights/know-the-facts-direct-registered-shares.

Next, to exercise the economic right to buy or sell there must be an economic value, which is detached from the share and the place it is stored.

Part 3: https://lemmy.whynotdrs.org/post/331876

Blurring: "Massive naked short positions need to be looked upon as huge assets." (2004) Where we are and what lies ahead. (3/3)

PREFACE – A quick little short squeeze

SOME OF THE GREAT DD AND ITS CONNECTION TO GAMESTOP AND THE STOCK MARKET

HOW LONGS WIN THIS WAR – SOMETHING THEY WILL NEVER FORGET

- What is a share and where is it held?

- How many entities technically have access to a share?

- Where are the shares traded and how is the price derived?

- How regular people think price discovery works and how it actually works?

WHAT NEEDS TO CHANGE FOR A FAIR MARKET

HOW LONGS WIN THIS WAR – SOMETHING THEY WILL NEVER FORGET

- Where are the shares traded and how is the price derived?

Economic value is defined by the exchange (or OTC) where the share is traded. The market capitalization of a company is defined by the public exchange where the security is mainly listed, e.g. NYSE or NASDAQ.

For some security this exchange will have not the most volume, which is kind of odd isn’t it? Also the security might trade on foreign exchanges or in dark pools, the latter often deriving the price from public exchanges (https://www.investopedia.com/terms/d/dark-pool.asp), while having far greater volume than the public exchange.

Those exchanges use an order book to match bids for supply and demand. Watching the the Wallstreet Conspiracy (https://www.youtube.com/watch?v=26_IcexvePA) or The Problem (https://www.theproblem.com/episode-5-the-problem-with-the-stock-market/) it’s always about scraping pennies on the dollar. So doesn’t really feel that bad, does it?

Let’s recap how regular people think price discovery is working and see how price discovery it’s actually working with all we learned during the journey.

- a How regular people think price discovery works?

Supply & Demand sets the Price. You can think of this as an orderbook, so for a price of $25 there are buy orders for 50 shares, while for a price of roughly $11 there are buy orders for 150 shares.At the same time for $25 there are sell orders for 150 shares and at ~$0 only 50 shares are paper handed. The intersection of those curves is than what defines the market price which is roughly $15 with a volume of roughly 100 shares exchanged hands.

Sounds easy right? And would look like this: ! Price is where Supply and Demand meet, 𝑄𝐷(𝑃)=𝑄𝑆(𝑃) where Q is quantity of D(emand) and S(upply) at a certain (P)rice (see: https://www.core-econ.org/the-economy/v1/book/text/leibniz-08-04-02.html)

Thanks to a young boy from Bulgaria (Vlad Tenev, https://www.youtube.com/live/RfEuNHVPc_k?t=1305) GME investors soon learned about Payment for Order Flow, which would route orders to wherever the counterparty, mainly Citadel and Virtu in our case, wants. The Problem with Jon Steward (https://www.theproblem.com/episode-5-the-problem-with-the-stock-market/what-is-the-stock-market) and also the movie Gaming Wallstreet (https://www.imdb.com/title/tt18332840/) brought the concept on the big screen.

The Problem states that this scheme is to make pennies off of every transaction processed. However, Dark Pools were literally defined to do large trades without price adverse effects on the price [https://www.investopedia.com/articles/markets/050614/introduction-dark-pools.asp]. Some of them use the past price of lit exchanges (https://www.investopedia.com/terms/d/dark-pool.asp), where individual investors trades barely go to. Rereading some old DD it feels like there are some logical flaws in the early DDs. Like this post claiming "I don't believe you can suppress the price of a stock through manipulation that only involves dark pools or off-exchange trading, as it is all publicly reported." (https://www.reddit.com/r/Superstonk/comments/o70lid/dark_pools_price_discovery_and_short/). But I rather agree with the logical deduction in the comment (https://www.reddit.com/r/Superstonk/comments/o70lid/comment/h2w36ex/?utm_source=reddit&utm_medium=web2x&context=3).

Price is a function of supply and demand (like shown above). If you now print several different graphs instead of one and spread demand over them the individual demand is lower, while as a big market maker supply is not a problem even without naked shorts. So naturally the price will be lower when having several exchanges with lower demand but high supply (sponsored by the liquidity fairy). As example, let’s take lemonade stalls. Supply of lemonade is ample. So imagine, there is just one stall and everyday there is a huuuge queue (high demand) in comparison to you having one stall but there are like 10 more lemonade stalls around you and the queue would spread equally. In which scenario would it be easier to raise the price of lemonade? Easy, isn't it?

Further there are settlement delays (T+2 at least) and shorting which allow broker-dealer and market makers to temporarily inflate supply and thus lower the price. The graph would change to the following:

! Changed equation: Price is where increased Supply (by shorts and settlement delay -> QSi) and reduced Demand (by routing -> QDr) meet, 𝑄𝐷r(𝑃)=𝑄𝑆i(𝑃)

Wow we just lowered the price of the shares and also the market cap of a company.

Interestingly through the GameStop sneeze saga the size of the trades handled by dark pools shrank (https://www.reddit.com/r/Superstonk/comments/mx4j9p/dark_pool_dd_summary_and_a_quick_update_on_all/) leading to the theory of retail orders having no more influence on the share price.

Even if synthetic shares are mentioned here and then, even on The Problem with Jon Steward, it’s almost never clearly put like Mark Cuban put it “[t]heir goal is to never [close] their short”.

I didn’t understand it when he said it, but its as simple as that: someone sells shares, collects 100% of the money and doesn’t actually deliver the share, forever.

So, if you want to cellar box a company somewhen even temporarily inflated supply would not be enough to reach a certain price point. “Finance professor (not me) mathematically proves that it's impossible to short a stock to zero without naked shorting at least as many shares as there are outstanding, doubling the float in the process” (https://www.reddit.com/r/Superstonk/comments/nw8281/math_black_magic_vol_1_why_it_is_mathematically/ ).

Everything changes if supply can be inflated indefinitely. And naked shorts are just one way, finra often fines broker-dealers for wrongly labelling shorts as long [see Citadel has no clothes], also there is perpetual rolling and many more (see https://www.petepetit.com/mimedx/downloads/Counterfeiting-Stock.pdf). Synthetic shares are additional to the outstanding shares, meaning shares that should not exist.

- b How is the price actually discovered?

Adding synthetic shares the Price is now where already reduced Demand (by routing -> QDr) meets infinite Supply (QS∞), 𝑄𝐷r(𝑃)=𝑄𝑆∞(𝑃), which obviously is at some point ~0, or should we say finally cellar boxed.

Imagine MOASS starts, Tomorrow was Today, in which of the above systems would you rather want to be?

What are implications of “Supply & Demand” being actually “(routed to lit market) Demand & (synthetic) Supply”?

- The seller of a synthetic share receives 100% of the cash but giving 0% of additional value. (The buyer receives some value still, e.g. the economic value and maybe partial voting rights)

- Derivatives are tied (mostly leveraged) to the price of the underlying, so little swings in the price can mean huge swings for derivatives. (if the price moves to much from the perceived fair price and investors are willing to invest/divest huge swings are not possible w/o moving the perceived fair price or buying power)

- The company loses market capitalization and thus value which credit score is tied to but also suppliers will look cautiously at the market cap and probably revise their payment terms (e.g. upfront payment instead of late payments).

- Cellar boxing and bankruptcy jackpot become possible only with naked shorts.

- …

In 2004 blurring wrote "[t]hese massive naked short positions need to be looked upon as huge assets that need to be developed." (https://investorshub.advfn.com/boards/read_msg.aspx?message_id=2543759). So what are the steps to do so?

WHAT NEEDS TO CHANGE FOR A FAIR MARKET

A massive short squeeze may not happen with GME under current market structure. Too many entities have access to shares in a way that the supply/demand relationship can always be manipulated through a nearly endless number of tactics including corrupt exchanges to suppress true price discovery. The main way an individual investor can change the current situation is by limiting access to their shares to exclusively themselves and that’s through the DRS system.

The second part beside exclusive ownership is something we cannot do ourselves easily. It’s an uncorrupt exchanges like tzero or loopring doing the absolute majority of the trades.

Only with those two pieces in place a large short squeeze may begin to unfold. The foundation of that happening is due to large short positions that exist as a hidden asset. The asset exists, but it’s hidden and therefore isn’t reflected in current market price. It is only through the extraction of this hidden asset that it will contribute to fair market price for the stock.

Exactly, lets assume shorts would be margin called and must buy at any price (which surprisingly didn't happen in Jan 2021 if you recall the SEC report). But will there be a seller for any price? In short, I don't think so. Do you?

Honestly, I am not sure how MOASS will really look like. And of course any hedgie would tell you how it looks like, like with the Sneeze being the Squeeze in Jan 2021. Haha, there was a like 30 slide set in like 20 versions claiming in a later version that FTDs would be unwound no matter what, just remember reading this and nearly crying how hard hedgies tried but how dumb they thought us to be (it was promoted by rensole at the time and called "The FTD Squeeze theory and the coiling spring"). So the psychological part will certainly play a huge role here ("SELL NOW, [INSERT COMPELLING REASON HERE]!").

This is why I always found concepts like buy, hold, DRS and the infinity pool very easy and compelling. I don't fully agree with no cell no sell, because its system change not single scape goats in prison I want. But I like the message it sends.

Lets theorize:

- the amount of naked shorts gets larger every day (see short % of daily volume)

- to make naked shorts = 0 they need to either bankrupt the company or a lot of people sell so we get back to shares owned = shares outstanding

- you can 10x or 100x the stock price and people would rather buy than sell... WHAT????

- in a MOASS scenario price rises which leads to FOMO - THIS IS WELL TESTED! (see also the Sneeze which was nearly pure buy volume (https://www.sec.gov/files/staff-report-equity-options-market-struction-conditions-early-2021.pdf , p. 28)

- with the knowledge about DRS and infinity pool with a rising price, every DRSed share becomes more valuable. Its like bringing money to a bank with a niiiceee %age. For every seller there will (or might) be a buyer beside the one trying to cover the naked short.

- Ultimately, the price becomes infinity, no matter how much volume is traded. Perfect price elasticity.

DRSd shares could become like the Mona Lisa. There is just one (real share for each outstanding). There are estimates, but ultimately its Priceless. PED = ∞ at P = ∞.

This is a nice theory. Becoming true, it could brake the financial market.

Or to just put it another way round, this is real infinite loss expressed, which before were just words.

Tales of Death of the Liquidity Fairy. Price elasticity for the Stonk Market.

I just came across a research I did a year ago and wanted to share with you further evidence from another angel that the stock market is rigged (not only GME, surprise, surprise) and how to test this.

Boring theory.

Ever wondered how much a change in price would change the demand (and supply) of a product? And vice versa how much a change in demand would change the price of a product?

If the price of gas rises will the demand shrink and if so by how much?

If the demand for stocks rises will the price rise and if so by how much?

Common sense would suggest with rising demand the price of a stock should rise, right? (Okay, okay, we already know about Dougie the liquidity fairy and his friends).

This concept is called price elasticity (of demand/supply) and measured by the coefficient of price and demand, which could be anything between

- perfectly inelastic (demand doesn’t change no matter the price)

- Inelastic (demand changes less than the price)

- Unitary elastic (demand changes in union with the price)

- Elastic (demand changes more than the price)

- Perfectly elastic (demand is detached from the price, welcome to the

- MOASS scenario haha, Kenny and Dougie are looking forward to very perfectly elasticity)

There is ample research on the topic as well on the demand as on the supply side.

Would you buy less gas if the price doubles? Probably not, which COVID and inflation when travel restrictions were lifted clearly showed. Demand was relatively constant while prices shot up.

Was this already predicted? Oh yes, demand for gas was always very price inelastic.

Buff waff abouf Mayonnaise?

What about MAYONNAISE I hear you say. It just depends on whether you are a loyal or non-loyal consumer:

We also get a feeling on price elasticity. So we see detergent nearly perfectly inelastic for loyals, gas being inelastic, Mayonnaise for loyals unitary elastic (they should, floorcloth for non-loyals being very elastic. Nobody buys floorcloth if price goes up!

What do you think is the price elasticity of the stock market? Make your guess, maybe Pulte is buying you a burger if you are right.

Here are some more examples, also since in high inflation, high interest rate times it could be good to know how demand is behaving here are some more

! (Source: https://scholar.harvard.edu/files/alada/files/price_elasticity_of_demand_handout.pdf)

Okay, so in general one (or in this case Investopedia could say) “When a good or service is a luxury or a comfort good, the demand is highly price-elastic when compared to a necessary good. Conversely, the demand for an essential good, such as food, is generally price-inelastic because consumers still buy food even if the price changes.” (https://www.investopedia.com/ask/answers/040715/which-factors-are-more-important-determining-demand-elasticity-good-or-service.asp)

Now, how would stocks behave? What number would you assume? Ready for Pultes burger?

And of course how would stocks we like behave?

And would there be differences for stocks which are mainly owned by individual investors vs. institutional investors (mainly, like >140%....)? But this is for another time.

Of course we have data also on the stock market. A study from 2021 found “[…] both theoretically and empirically, that the aggregate stock market is surprisingly price-inelastic in general […]”.

Ah, yes, ah, surprisingly. Not only for meme stocks, but for all stocks the demand does not really change a lot with a change in the price. The study found a coefficient of 0.2 which would be comparable to gas or coffee. So the price changes 100% while demand would only change 20%. But also a small change in demand would hugely impact the price.

Stonks we like in comparison.

Now, lets do this for some of our favorite stonks as well as some other well-known ones.

! (Monthly aggregated values based on daily close prices from 2019-01-01 to 2023-09-13: one can perfectly see the capital inflow post 2020-03, GME price elasticity picking up after the Sneeze and the market going nuts in 2023-Q2/Q3)

All the time we talked about numbers between 0 and infinity (I like infinity), why are some stocks below 0 here?

They do the reverse. As the price goes up, demand goes up, too. Price goes down, demand goes down, too. Like for really luxury products, the higher the price, the higher the demand (expensive Champagne, Rolex Daytona, Tesla, Apple, Microsoft,… and AMC in August???).

I didn’t dig too much into AMC, but there was the 10:1 stock split August 24, the 40m new shares offering finished September 13 and a lot of price movement.

What stings out is the rather flat line 2018, 2019, 2020 for GME and BBBY. Especially GME hovering around the perfectly inelastic demand. Again, this means the price is detached from any volume change… of course it is, greetings to the finest investors of our time, Ken and Dougie.

One could form a thesis that those two stocks were obviously price controlled with a clear price target being ~0, until something broke.

Even if you didn’t get a burger from Pulte you now know what price elasticity is, how elastic Mayonnaise is, that the stock market behaves counter intuitively and especially GME and BBBY look the most manipulated.

Looking forward

rom all we know (cellar boxing, dark pools, naked shorts) we can safely say that the price in the current system will never be a real output of supply and demand. Thus it is to question if price discovery for the whole stock market is real at all.

But there are boundaries. With GME in late 2020 and January 2021 one could theorize that the buying pressure in relation to the former very low stock price got too large. Also that BBBY is in a similar position right now.

So if whatever stock comes out successful of a restructuring (or near certain bankruptcy like GME in 2020/21) the valuation changes and the stock price has to be adjusted for one or two orders of magnitude (like $4 -> $400 now $80, BBBY from $0.2 to we will see).

That is without a real price discovery, just avoiding an insane buying pressure w/o a certain bankruptcy (and most probably to profit from derivate trades after the price adjustment). We’ll call this disruptive price adjustment to valuation (Level 1).

And yes, that’s a nice play. But it doesn’t foster all those nice naked shorts, or any short covering at all. Remember mcuban, shorts don’t plan to ever close, also see the SEC report on the sneeze showing nearly no short covering.

Okaaay, who of you sweet little stocks already had a short squeeze? OSTK, you? The PED (price elasticity of demand) went up from 0.04 to 0.11. Hmm and getting into perfectly inelastic territory right after??

Also even if FTDs for OSTK went down, it traded its outstanding shares 2017: 6x, 2018: 14x, 2019: 19x, 2020: 25x, 2021: 11x while also institutions own ~80% of the outstanding shares. I don’t think we saw a real short squeeze here either.

So for a real shortsqueeze and especially MOASS including an infinity pool, we would assume a rather (perfectly) elastic price curve (PED > 1). The price will remain astronomically while the demand is huuuuuge. We’ll call this MOASS with real price discovery (Level 2).

TL;DR: we never passed disruptive price adjustment to valuation (Level 1). MOASS will require real price discovery, which potentially would be visible due to a change in price elasticity of demand. The question remains whether real price discovery is part of the plan, if so there will be fireworks.

When the DTCC shares concerns regarding "safeguarding of funds and securities by transfer agents".

“Securities held pursuant to […] share plans (dividend reinvestment, direct stock purchase, etc.) should be registered such that they could not be considered property of the transfer agent. (https://www.sec.gov/comments/s7-27-15/s72715-40.pdf, p.12)

“DTCC shares the Commission’s concerns that securities and funds held by transfer agents are subject to a risk of loss from fraud, theft or other misappropriation or disruption and supports the Commission’s proposals to strengthen the practices and procedures involving the safeguarding of funds and securities by transfer agents.” (https://www.sec.gov/comments/s7-27-15/s72715-32.pdf, p. 8)

"[...] Plan Administrators maintain custody of purchased shares on the participants’ behalf, with the purchased shares typically being registered in the name of the transfer agent’s nominee." (https://public-inspection.federalregister.gov/2015-32755.pdf, p. 194)

Oh it did stayed up in r/gme https://twitter.com/AmaniYubyoung/status/1692550742945435888

While superstonk deleted it. I asked why and they said I should link the source, I gave the source and they said I should provide the page number (since it's 209 pages). Thats now 2 days ago, didn't here back.

Cool you are here!

Plan Shares typically are not under your name, sincerely, SEC 2015

Source: https://public-inspection.federalregister.gov/2015-32755.pdf)

"Should transfer agents be permitted to receive payment for order flow in connection with Issuer Plan transactions?" (https://public-inspection.federalregister.gov/2015-32755.pdf, p. 201)

Source: https://public-inspection.federalregister.gov/2015-32755.pdf, p. 201

Do DSPP shares ever leave the DTC?

Thank you so much for the post. So important to be open minded ... there is so much to learn. Oh man, this journey is wild and I love being part of it.

Regarding the float, that statement is false. Actually, the GameStop float was negative for many years as institutions alone held well over 100% of outstanding shares (see e.g. https://i.redd.it/c44cmb67mtf61.png).

Welcome. I was also blown away by it...

@[email protected] thanks for clarification.

Thinking about other ways to avoid brokers being able to unDRS I found that one may also just change account address details:

"So basically, brokers aren’t supposed to do this, but can, and if they do, there’s really nothing stopping them since there’s no check first to see if there was permission from the account holder. [...] In the meantime, as suggested by the reps, if possible, change some account info so it doesn’t match what your broker has on file, like changing Street to St or adding a middle initial." (https://www.reddit.com/r/computershare/comments/xfcpq3/comment/ioltp8n/)

Also on Twitter there is a discussion about "stop trades" and one of the things it would help with is brokers being able to unDRS. Either a new account or changing address details would do the trick also.

REPOST Welcome to the Options Casino aka Wendy's - Cashing-Up Options with Strikes for 01/21/22 and 02/28/22. Option Buyers lost at least $81m for which at least 720k shares could have been bought.

This is a repost of my analysis on GME options from March 22 I posted in DDintoGME (highly censored sub nowadays). I feel price movement is a thing we should start discussing again and its implications.

Edit #1: Making it more clear that it is daily data for each combination of Strike Price and Date. Thanks to u/dexter_analyst.

Ladies, Gentlemen, Apes and shf interns,

Welcome to the Options Casino aka Wendy's.

Please start with the disclaimer: this is not financial advice. I am retarded. I only eat black and red crayons. All data is only a sample and incomplete, since not all Strike Prices and only daily data were analyzed. Furthermore, this post shouldn’t discourage or encourage you from buying options rather help to understand past trades and also encourage finding the right questions about option trading in the future.

TL;DR: Option Buyers lost at least $81m for which at least 720k shares could have been bought. This post shows data for Apes to question, since data about options is hard to get. The analysis of the data showed that Options Buyers for those two strikes lost at least $81m while investing at least $97m. So roughly 83% of the invested money was lost. To get the complete picture ALL strike prices should be analyzed.

Questions this post tries to answer:

- How did call options for 01/21 and 02/28 turn out for option maker and option buyer (per strike)?

- In what timeframes call options could have been bought turning a profit?

- Did the positive options sentiment in November have an impact on OI change for the analyzed Strike Date 01/21?

- How many shares could have been bought instead of the option contracts?

Feel free to add any question in the comments. Also, I would be happy if someone wants to verify the data or could even add (e.g. level 2 data).

How I arrived at the data:

- Source: iexcloud.com

- I chose two option strike dates 01/21 and 02/28 as those had pretty high OI (184,726 being roughly 18m GME shares and 107,981 roughly 11m GME shares).

- I chose the strike prices with the highest OI (see below) and got the daily data for each strike price leading to roughly 4,500 data sets.

- This data represents 67% and 58% respectively of total OI at Expiry.

- Since I only got daily data I calculated the option cost with an average options price ((daily high – daily low)/2 * daily change in option OI). I neglected options volume since I only wanted to know the value between option buyer and option maker.

- I added up all the daily costs to Call Buyer Costs (till Expiry). Those costs can be negative, since OI could have been reduced at a loss for Option Makers (buy back or early execution).

- The Call Buyer Profit is than the value of the remaining Options at Expiry minus the Call Buyer Costs.

- As you will see, also strike prices being OTM led in rare cases to an overall profit for the Options Buyers due to probably Options Maker buying back at a loss before expiry.

Declaration:

- OI at Expiry: the remaining OI at the end of the expiry day. Could have been executed, turned into a cash profit last second or expired worthless.

- Call Buyer Profit: This is the total Call Buyer Profit or loss if negative, meaning the value of OI at Expiry minus Call Buyer Costs.

- Call Buyer Costs: Total Costs for the Options Buyer derived from daily trades. As mentioned above Call Buyer Costs can be negative if Option Maker bought back options at a loss for them.

For orientation and since I just couldn’t overlay the graphs, here is a graph of Daily GME $ Price where day to day was +/-10%: https://imgur.com/DSynOfG

1. How did call options for 01/21 and 02/28 turn out for option maker and option buyer (per strike)? (Bold -> Overall Profit for Option Buyers)

Costs can be negative if Option Maker bought back their options (reduced OI) at a loss for them. Therefore 01/21 $150 turned a profit for Call Buyers overall even if ending OTM.

2. In what timeframes call options could have been bought turning a profit? (Graphs do not include the value at the actual strike date)

-

Profit / Cost over time for Strike Date 1/21 - Prices $15-150: https://imgur.com/g8Mb69l > Zooming into June one can see that no $150 contract was sold at the top (Jun 8) while many were sold or executed Jun 4 and Jun 9. On Jun 18 some bought more of this contract: https://imgur.com/ZuQOTZX

-

Profit / Cost over time for Strike Date 1/21 - Prices $200-950: https://imgur.com/knmgBXp > Comparing those to the Strikes below 200 one can see that Option Buyers put a lot more money in the 200 and higher prices, but were only able to turn a profit for 200 and 250 Strikes in March and June. Zooming in into those months one can see huge trades on the peak of March 10 and the run up in early June: https://imgur.com/7Vn2ele

-

Profit / Cost over time for Strike Date 2/18 - Prices $80-100: https://imgur.com/vGBQaTb > As one can see when compared to the table 1) most profits were made at the strike price. Still some executed or sold the two days prior expiry.

-

Profit / Cost over time for Strike Date 2/18 - Prices $120-510: https://imgur.com/F8ilDXT

> No luck for those with Strikes above 120. Some tried to minimize losses at Jan 26.

3. Did the positive options sentiment in November have an impact on OI change for the analyzed Strike Date 01/21?

- Actually, it's not that clear. When looking at the graph "Profit / Cost over time for Strike Date 1/21 - Prices $200-950" November had the biggest investment since the run-up in June while the run-up in Nov was comparably small. However, other factors could have played a role, like time to expiry.

- Just fyi: Daily data for October to December for this Strike Date: https://imgur.com/IZ2MspU

4. How many shares could have been bought instead of the option contracts?

- For the data analyzed there could have been bought 722,845 shares . As not all Strike Prices were analyzed one can assume that more shares could have been bought, thus at least 722k shares could have been bought instead of options. This assuming the daily change in OI and thus the change in cost or profit would have been invested or divested with the daily average share price at the date of the options trade. Finally, the value at expiry is subtracted.

That's it Apes. Hope it'll help with understanding option trades and gaining some wrinkles.

💎🙌 🚀

Link to the archived version: http://web.archive.org/web/20220310125927/https://www.reddit.com/r/DDintoGME/comments/tay3w6/welcome_to_the_options_casino_aka_wendys/

REPOST (r/Superstonk, June 2022): State of the Dip #2a - How are dips and rips affecting estimated DRS'd shares?

This is a repost of the time when real dips and rips still happened from June 22 I posted on Superstonk (highly censored sub nowadays). I feel price movement is a thing we should start discussing again and its implications. Price as well as % DRS seem to be in "zen mode" lately for the last roughly 1y. We should talk about this! Special thanks to u/jonpro03 who helped me with all the data for the OG post.

Sup Apes?

In my post about "How is the probability of another monster dip? What are the determining factors for price movements and vice versa what do price movements cause?" with the hypothesis "GameStop share price will be below $77 caused by GDP slowing and liquidity drying up", I also talked about that "[t]he slope of "Total DRS Estimates" increases significantly after the dip in March, May and January as can be seen on https://www.computershared.net/ ".

This post now should give a glimpse on what dips and rips actually do cause. However, this is not proper statistic work and should only be seen as rough estimates. Especially since I am building on the data of computershared.net which contains estimates by itself (esp. the trimmed avg.).

TL;DR:

- All else equal DRS might pick up by a factor of 2-4 during the next dip (around $70-$90) leading to daily estimated DRS volume rising from 20-35k to 50-90k shares/day.

- Opinion: Hedgies are fukd because if they lower the price Apes accelerate their DRSing, if they raise the price they risk causing FOMO also from none Apes, esp. during times were other stocks are down hard.

Findings:

- After Dips Apes have DRS'd 3x (about 2-4x) the amount of shares in comparison to after / during Rips. In "rip" timeframes Apes DRS about 20-35k shares/day while during "dip" timeframes Apes DRS about 50-90k shares/day (varying for the dips/rips). !

- There is a positive correlation between Price and "Day+4 (DRS) growth" (0.24). Interpretation: When the price rises after a dip, DRS'd shares rise.

- There is a significant positive correlation between Volume and "Day+9 (DRS) growth" (0.45). Interpretation: High volume days almost certainly lead to a peak in DRS'd shares over the next 9 days.

- There is a positive correlation between Volume and "Daily Price Delta" (0.35). Interpretation: with high changes in price (regardless if dip or rip) there comes higher volume.

Data used for the dataset:

- Daily low, Daily Volume: were taken from https://chartexchange.com/symbol/nyse-gme/historical [as of June 27]

- Daily Price Delta: the % difference in price regarding the day before (ignoring algebraic sign)

- Daily Price Delta in regards to 14d mean: Daily low divided by the arithmetic mean of the previous 14 days

- Estimate w trimmed mean: was taken from https://5o7q0683ig.execute-api.us-west-2.amazonaws.com/prod/computershared/dashboard/charts [as of June 27] (thanks to u/jonpro3, see https://www.reddit.com/user/jonpro03/comments/v3iyt4/how_does_computersharednet_work/)

- Daily DRS Volume: the absolute difference between "Estimate w trimmed mean" to the day before

- Day+4,+9,+19 growth: the sum of the "Estimate w trimmed mean" as of this date as well as the next 4, 9, 19 days to better illustrate

Assumptions:

- Growth in estimated DRS'd shares follows an repeating timely pattern and there will be visible peaks around such timely patterns visible by a peak of DRS'd shares over the next 4, 9 or 19 days. This includes the timeframe from buying (and DRSing from a broker) to posting.

- As I found that the time DRS picked up varies between each dip/rip I kind of manually assigned each dip/rip timeframe on the price side (left) and on the DRS volume side (right). I assumed that a dip is when the price relative to the 14d mean price is roughly around or below ~90% and that the relating DRS volume is around or slightly after this timeframe and is defined by an up rise in "Daily DRS volume".

- The timeframe for analysis started December 2021, since DRS before is assumed to be unrelated to price movements (first batches).

Limitations:

- I used my magic 8-ball for a lot... maybe some of you want to do a proper analysis with more time?

- The definition of DIP/RIP timeframes is not simplified and not properly done. I more or less used some crayons and just let them drop where the colors looked nice.

Happy to provide the dataset. Let me know what you think in the comments. The time I used for this was very limited, so please check for failures. And as said before, don't rely on this data or results.

Link to the archived version: http://web.archive.org/web/20220701032716/https://www.reddit.com/r/Superstonk/comments/vo7j41/state_of_the_dip_2a_how_are_dips_and_rips/

So, we know the price kept going down since this post, so the hypothesis was partly right:

Since nearly a year the price is boring af and sticks around $20-$25. Also the DRS numbers don't show a steep increase, rather a steadily plateauing:

So everybody lost their interest? The splividend showed deep fukry, we had a profitable quarter, RC is now executive chairman, there is $1.3bn in cash - no bankruptcy in sight, although the new marketplace/nfts didn't lift off yet.

So in this stagnation, is there an opportunity? This is what my head can't stop thinking about.

REPOST (r/DDintoGME, June 2022): State of the Dip #1 - How is the probability of another monster dip? What are the determining factors for price movements and vice versa what do price movements cause?

This is a repost of my thoughts on GME price movement from June 22 I posted in DDintoGME (highly censored sub nowadays). I feel price movement is a thing we should start discussing again and its implications. At the time of the post the low was [$19.25], the new low was [$15.41] in January 23. I added the price after the splividend in [brackets].

Hey Apes, Ssup? [...] Disclaimer: ``` This post is not to discuss opinions about people. Just possible price movements, especially on the downside, like materially aka monster dip. Also it should discuss some thoughts about the price movements. ... ehrm, this is not financial advice and I am treated for crayon addiction.

```

TL;DR:

- Some twatter posts formed the hypothesis "GameStop share price will be below $77 [$19.25] caused by GDP slowing and liquidity drying up"

- Price so far followed a "slide pattern" (up steeply, down gradually) with varying frequency to probably discourage new buyers. Also prices lead to maximized option maker profits. Apes bought and DRS'd the fkn dip and probably will do so again. SPECULATION: price upper bound is as low as possible also to discourage new investors.

- Questions to be clarified in Part 2: How much does GDP slowing aka recession combined with inflation lower Apes buying power? What's the ratio of buys vs sales in a monster dip under the conditions of 1 accompanied by massive MSM FUD? SPECULATION: price upper bound is as low as possible also to discourage new investors.

Part 1: The hypothesis.

Okay, the reason for this post - and again this should not be about people - were several twatter posts of Pulte - did I say that we don't want to discuss people here? - which made me think. Will and can there be a monster dip?

For those who haven't read the posts or can just remember the last 8 minutes because of massive TV addiction in their childhood, here they are:

Apr 12 (price low on this day: $141 [$35.25], high: $152 [$38]): >"[...] Only concern is short term stock price going down, potentially materially, with GDP slowing and liquidity drying up. [...]"

(Source: https://nitter.net/pulte/status/1513961584263110668)

May 12 (price low on this day: $77 [$19.25], high: $108 [$27]):

[Cited Tweet Apr 12] >"[...] I will HODL GameStop and at the right time I will buy more. It’s not time yet though. [...] Be smart! 🦍"

(Source: https://nitter.net/pulte/status/1524870198746046485)

Jun 7 (price low on this day: $126 [$31.5], high: $149 [$37.25]):

>"[...] Again, I think downtrend is next, but still! How great! 🚀"

(Source: https://nitter.net/pulte/status/1534276687340441600)

Well, I am not sure if I mentioned that this post is not about people. Here you go. So we will abandon people for the time and phrase an hypothesis "GameStop share price will be below $77 [$19.25] caused by GDP slowing and liquidity drying up".

Before we think about how to test this hypothesis lets dive into A) the extend of it and in general discuss B) factors that may determine the price movement as well as C) vice versa effects of the price movement.

A) Since you all know the GME chart by heart this may be no news to you. Looking at the share price since June 2021 the lowest point was $77.58 on March 14, followed by May 12 with $77.77. So within one year the lowest dips were on and around those two days, followed by late January. (Source: https://chartexchange.com/symbol/nyse-gme/historical)

B) Of course price is a function of demand and supply. Nah, just kidding, the price is fake af and under working theory caused by the following:

- As absolutely dominant factor since the big sneeze we see a "slide pattern", so like with a slide for kids it goes up very steep, coming back down gradual (see chart https://chartexchange.com/symbol/nyse-gme/). As speculation I think this is mainly to discourage possible new shareholders as the price goes down nearly all the time. Last year nearly every day new patterns were thought to be found on why and when the next upward movement would occur, but none really survived the "next cycle" and being absolutely crushed December last year to mid March this year.

- Options play a further significant role. We see that most options end up expiring worthless (e.g. see here[OPTIONS DD LINK TO BE UPDATED]). Yes, one can make significant money with options - if one is right predicting the price movement. But price mostly moves to max pain, sometimes even below to crush more calls than puts (especially in Q1 22). If I find the time and someone is interested I maybe will publish the data in a different post. As speculation price at any given time may reflect a strategy by option makers to maximize their earnings.

- SPECULATION: On the upper side the price is capped by

margin calls(note: there are no margin calls for the big player),keeping the balance in their books(note: there are so many ways to hide their positions like swaps, companies abroad, ...). So the only real reason I can see to keep the price low is to just show new investors that GME is not an attractive investment.

C) What does price movement cause? You guessed it. Apes keep buying and DRSing the dip. The slope of "Total DRS Estimates" increases significantly after the dip in March, May and January as can be seen on https://www.computershared.net/. Also RC bought the dip on March 22 (Source: https://fintel.io/n/cohen-ryan). On the other hand it looks like high prices are followed by a decreased slope. Would love someone to run some statistics. What do you think u/jonpro03?

So yeah, nothing new, but an interesting comparison. Bananas cheap = Apes buy more bananas. Bananas expensive = Apes buy less bananas. As always.

TL;DR: Price so far followed a "slide pattern" (up steeply, down gradually) with varying frequency to probably discourage new buyers. Also prices lead to maximized option maker profits. Apes bought and DRS'd the fkn dip and probably will do so again. SPECULATION: price upper bound is as low as possible also to discourage new investors.

Further statistical research could be done on how the price influences DRS rates to better predict them in the future.

Part 2: How to test the Hypothesis.

Originally, I wanted to also post my conclusions to Part 2 already. But I decided to rather publish the questions first and get your thoughts on those, maybe add some as well as your thoughts on their answers.

So, how can the hypotheses "GameStop share price will be below $77 [$19.25] (aka the monster dip) caused by GDP slowing and liquidity drying up" be tested?

- How much does GDP slowing aka recession combined with inflation lower Apes buying power?

- What's the ratio of buys vs sales in a monster dip under the conditions of 1. accompanied by massive MSM FUD?

Your thoughts are very welcome.

Just some thought exercise until MOASS.

Shiver me timbers.

Link to the archived version: http://web.archive.org/web/20220623215829/https://www.reddit.com/r/DDintoGME/comments/vjlswr/state_of_the_dip_1_how_is_the_probability_of/--

Interesting, thanks Chives. What happens if you ask your broker to you yourself become NOBO?

Edit: changed "your broker to become NOBO" to "your broker to you yourself become NOBO"

Thank you. Much luv!

Absolutely, even if this wasn't the main target, censorship gets way harder to proof. At the beginning of my DD I thought it was most likely that reddit (radmins) only acts passively. But as I finished and reddit banned DRSyourGME and more subs I now think it most likely reddit itself is deeply involved in censoring GME.

The censorship state of reddit and subreddits - Part 2

crosspost: https://lemmy.whynotdrs.org/post/12245